Advertisement|Remove ads.

AMD In Spotlight As BofA Hikes Price Target: Stock Draws Massive Retail Chatter Ahead Of Earnings

Advanced Micro Devices Inc.(AMD) received a fresh vote of confidence from Bank of America (BofA) ahead of its upcoming second-quarter (Q2) earnings report on August 5.

The firm boosted its price target on the chipmaker’s stock to $200 from $175 while reiterating a ‘Buy’ rating, as per TheFly.

Advanced Micro Devices stock traded over 3% on Tuesday afternoon.

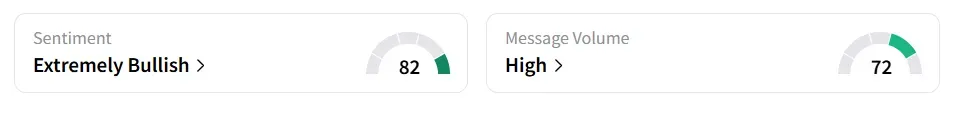

On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ (82/100) from ‘bullish’(72/100) territory the previous day amid ‘high’ message volume levels.

The stock saw a 381% surge in user message count in 24 hours.

Stocktwits users said they were looking forward to the earnings next week.

BofA anticipates strong long-term performance from AMD, forecasting that the company's share of the global CPU (Central Processing Unit) market could exceed 30% by 2026, a notable jump from its sub-20% market position in 2023.

Intel Corp.(INTC), AMD’s chief rival, is falling behind in pricing power, according to the brokerage.

AMD now commands a pricing premium of roughly 17% over Intel in the PC (personal computers) market and a steeper 64% advantage in server chips, BofA noted, underscoring AMD’s rising competitiveness in key segments.

Investors are closely watching to see if the company can meet or exceed expectations amid growing enthusiasm around AI-driven demand and expanding data center opportunities.

President Donald Trump’s recent executive orders aimed at accelerating advancements in artificial intelligence have fueled additional optimism.

The company anticipates $7.40 billion in revenue, compared to a Wall Street estimate of $7.43 billion, according to Fiscal AI data. Analysts expect the company’s Q2 earnings per share (EPS) to be $0.48.

AMD stock has gained over 48% year-to-date and over 28% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)