Advertisement|Remove ads.

American Express Gets Baird Upgrade Ahead Of 175th Anniversary, CEO Sees Sustained Growth: But Retail Mood’s Sluggish

American Express Co (AXP) shares gained over 2% on Friday after Baird analyst David George upgraded the stock to ‘Neutral’ from ‘Underperform’ with an unchanged price target of $265.

According to TheFly, Baird noted that the continuous sell-off in the broader market makes it challenging to remain pessimistic about the company’s "high-quality franchise.”

American Express should be able to deliver on lower revenue growth expectations in most operating environments given that a potential slowdown in consumer spending should support better loan growth while the currency environment has improved intra-quarter, the brokerage said.

Baird believes the stock's risk-reward ratio is balanced.

American Express will be celebrating its 175th anniversary on March 18. CEO Stephen J. Squeri expressed confidence that the firm is well-positioned to build on its strong foundation and drive sustained growth.

Squeri said his optimism is driven by several factors, such as the company’s differentiated business model, including its brand, global premium customer base at scale, and network of partners.

“We are continuing to invest at high levels in our innovation engine, value propositions, marketing, and technology, while maintaining our excellent credit performance and expense discipline. We have many attractive growth opportunities across our customer base, particularly with Millennial and Gen Z consumers, SME customers, and in key countries outside the U.S. to build on our strong momentum,” he highlighted in a letter to shareholders.

Earlier this month, American Express said it had signed an agreement to acquire Center, a software company modernizing expense management.

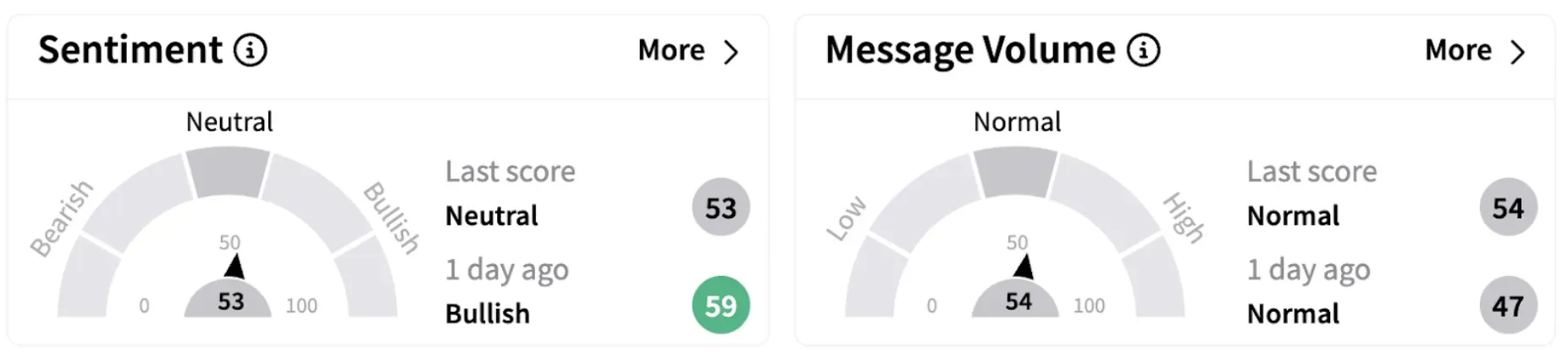

Meanwhile, on Stocktwits, retail sentiment dipped into the ‘neutral’ territory (53/100) from ‘bullish’ a day ago.

American Express shares have lost over 12% in 2025 but are up over 18% in the past year.

Also See: Nordic American Tankers Announces Fleet Expansion: Retail Sentiment Improves

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_gravity_jpg_173d7fb4ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)