Advertisement|Remove ads.

Americas Gold And Silver To Acquire Crescent Silver For $65 Million

- The acquisition includes $20 million in cash and about 11.1 million USAS common shares.

- To fund the cash portion, USAS entered into a “bought deal” private placement with Canaccord Genuity Corp. and BMO Capital Markets.

- USAS plans to launch a five-year drilling program beginning in 2026.

Americas Gold and Silver Corp. (USAS) announced on Thursday that it signed a binding agreement to acquire 100% of Crescent Silver, LLC, owner of the Crescent Mine in Idaho, for around $65 million.

The acquisition includes $20 million in cash and about 11.1 million USAS common shares, valued at roughly $45 million based on a price of $4 per share.

In addition to containing high-grade silver, the Crescent mine also contains copper and antimony.

To fund the cash portion, USAS entered into a “bought deal” private placement with Canaccord Genuity Corp. and BMO Capital Markets to raise gross proceeds of $65 million through equity financing.

The fully permitted Crescent Mine holds a high-grade historical mineral resource totaling 22.9 million ounces (Moz) of silver across categories. Based on prior studies, the mine could add 1.4 - 1.6 Moz of annual silver output, while also increasing the company’s exposure to antimony.

Its close proximity to Galena complex offers operational advantages, including shared processing, infrastructure, and workforce efficiencies.

With less than 5% of the property explored, Americas plans to launch a five-year drilling program beginning in 2026.

“Significant parts of the mine have yet to be drilled and we expect to target these with a US$3.5 million drill program commencing in 2026. While the near-term development at Crescent is potentially accretive to our silver and antimony resources, we are excited to test these areas to evaluate the strong potential for mine-life extension,” said Paul Andre Huet, Chairman and CEO.

Stock Watch

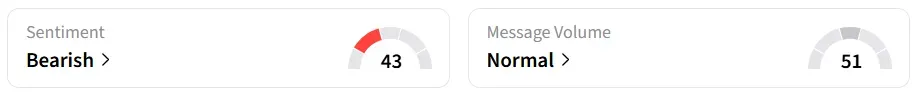

Despite the acquisition update, USAS stock fell 9.4%.

The stock has also remained in the ‘bearish’ territory over the past 24 hours.

USAS shares have seen significant buying interest so far this year, gaining more than 320%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)