Advertisement|Remove ads.

Analog Devices Stock Sees Best Week In 2 Years As Q1 Earnings Beat, Buyback Expansion Fuel Optimism – Retail’s Feeling Bullish

Analog Devices (ADI) shares climbed 7% in afternoon trading on Wednesday, extending a five-day rally after the chipmaker topped Wall Street’s first-quarter earnings estimates and issued an upbeat outlook for the second quarter.

Shares have surged 15.75% over the past week, marking the stock’s strongest one-week performance in two years.

The signal processing and power management semiconductor company reported earnings per share of $1.63, beating analysts’ expectations of $1.54, according to Stocktwits data.

Revenue came in at $2.42 billion, exceeding consensus estimates of $2.36 billion.

Alongside the earnings beat, Analog Devices raised its dividend by 8% and expanded its stock buyback program by $10 billion, bringing total repurchase capacity to $11.5 billion – equivalent to roughly 10% of its market capitalization.

Management highlighted that the company has been strengthening customer relationships and expanding its business pipeline amid the current semiconductor cycle.

Executives pointed to rising capital expenditures among major hyperscale cloud providers, including Amazon (AMZN), Meta Platforms (META), and Google (GOOG), as a key growth driver for 2025.

The increased AI infrastructure spending is expected to drive demand for Analog Devices' memory and high-performance solutions.

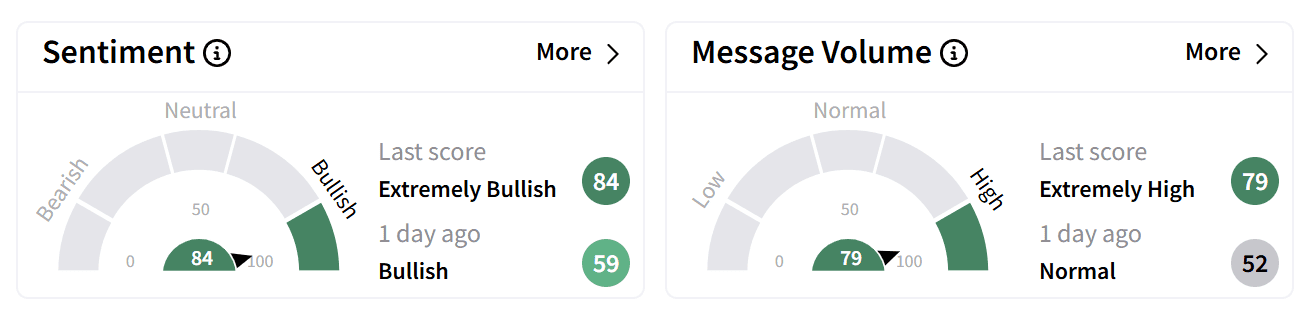

On Stocktwits, retail sentiment around Analog Devices surged to ‘extremely bullish’ from ‘bullish’ a day ago, as retail chatter jumped to ‘extremely high’ levels.

Most user comments on Stocktwits reflect a positive take on the stock.

Echoing comments from the previous quarter, executives said inventory levels have largely normalized, and strong customer ties have helped the company maintain a stable supply-demand balance.

However, they cautioned that broader macroeconomic uncertainty remains the primary factor influencing the pace of recovery.

Shares of Analog Devices have risen 27% over the last 12 months and over 10% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)