Advertisement|Remove ads.

Analysts Hail Alphabet’s Cloud Surge, AI Push, Sparking Bullish Retail Buzz

Wall Street is convinced that Alphabet Inc.’s (GOOGL) (GOOG) rapid strides in cloud computing and artificial intelligence (AI) are reshaping its growth narrative.

JPMorgan revised its price target on Alphabet shares to $232 from $200 while maintaining an ‘Overweight’ rating, citing the latest quarter as a “defining” moment driven by strong momentum in Google Cloud and scaling AI-related products, as per TheFly.

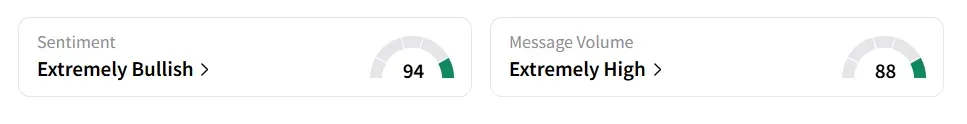

Alphabet stock traded over 1% higher on Thursday afternoon. On Stoctwits, retail sentiment around the stock stayed in ‘extremely bullish’ (94/100) territory. Message volume shifted to ‘extremely high’ (88/100) from ‘high’ levels in 24 hours.

The stock experienced a 506% surge in user message counts in 24 hours.

Stocktwits users expressed optimism about the company’s AI narrative.

Analysts believe that Alphabet’s AI-led demand and the expanding backlog position Google Cloud as an increasingly central part of the company’s long-term bull case.

Bank of America analyst Justin Post also raised the firm’s price target to $217 from $210 and reiterated a ‘Buy’ rating. In a client note, Post praised the quarter’s “bright spots” in Search and Cloud, interpreting them as signs that AI is expanding market opportunities.

According to Wolfe Research, as cited by CNBC, Alphabet’s performance adds fuel to a trend of rising AI capital spending, which may increase by 40% year-over-year in 2025.

After initially budgeting $75 billion in capital spending for 2025, Alphabet now expects to pour $85 billion into expanding its cloud infrastructure and AI capabilities.

Industry analysts, including Mark Shmulik of Bernstein and Randy Abrams of UBS, noted Alphabet’s gains in Search and Cloud as validation of its aggressive AI strategy.

Google Search revenue increased by about 12% to $54.19 billion, and that of Google Cloud jumped 31.7% YoY to $13.62 billion.

Abrams emphasized that Alphabet’s early report sets a tone for peers to potentially echo similar upbeat guidance, extending the market’s optimism.

The earnings report has not only impressed investors but also stirred broader expectations of an intensified AI arms race among the so-called “Mag 7” tech companies.

Alphabet stock has gained over 2% year-to-date and 12% in the last 12 months.

Also See: Wall Street Cuts Chipotle Targets As Sales Disappoint, But Bulls Dominate Retail Chatter

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263007357_jpg_aff2a32e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_XRP_original_jpg_005097c9e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261448901_jpg_dec7c2c9b9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_32b8924ac2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)