Advertisement|Remove ads.

Wall Street Cuts Chipotle Targets As Sales Disappoint, But Bulls Dominate Retail Chatter

Chipotle Mexican Grill Inc. (CMG) witnessed a wave of price target cuts from major Wall Street firms after delivering mixed second-quarter (Q2) results.

Despite better-than-expected earnings and margin performance, weaker-than-hoped comparable sales and macroeconomic pressures have prompted analysts to lower their expectations.

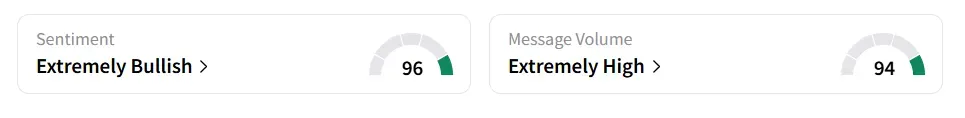

Chipotle Mexican Grill stock traded 14% lower on Thursday afternoon. But Stocktwits retail sentiment around the stock remained in ‘extremely bullish’ (96/100) territory. Message volume jumped to ‘extremely high’ (94/100) from ‘high’ levels in 24 hours.

Retail sentiment hit a one-month high while message volume levels are at a six-month high. The stock saw a 795% increase in message count in the last 24 hours.

A Stocktwits user expressed confidence about sales picking up in the coming months.

Barclays analyst Jeffrey Bernstein lowered his price target to $53 from $55, while maintaining an ‘Equal Weight’ rating, citing sluggish sales trends in May attributed to external economic headwinds, as per TheFly.

However, he noted that earnings and restaurant margins remained solid.

The firm's analysis highlighted a rebound in comparable sales during late Q2, which has continued into July, partly aided by increased marketing and easier year-over-year (YoY) comparisons.

"While we experienced a slowdown in our underlying trend in May, we did see momentum build as we rolled out our summer marketing initiatives and leaned into hospitality. And exiting the quarter, we returned to a positive comp and transaction trends, which have continued into July,” said CEO Scott Boatwright in the earnings call.

Citi followed suit, trimming its target to $62 from $68 but keeping a ‘Buy’ rating.

The brokerage believes that Chipotle’s current valuation remains attractive and could help maintain investor interest, especially as the company navigates its toughest quarterly comparison of the year in Q2.

Wells Fargo reduced its target to $60 from $65, reiterating its ‘Overweight’ rating, flagging the Q2 comparable sales miss, a shaky start to July, and a downward revision to the full-year guidance.

Nevertheless, the firm still sees reasons to support the stock, citing long-term growth initiatives and potential tailwinds in the second half of the year and into 2026.

BTIG also trimmed its forecast, lowering the price target to $57 from $60, but reiterated a ‘Buy’ rating.

Chipotle Mexican Grill stock has declined by over 24% in 2025 and by more than 12% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)