Advertisement|Remove ads.

Palo Alto Slides As Analysts Slash Price Targets Post Q3 Print, But Retail Is Buoyant

Palo Alto Networks, Inc. (PANW) stock traded 4.8% lower on Wednesday as several analysts slashed the firm’s price target following the company’s third-quarter earnings.

Palo Alto reported third quarter (Q3) revenue of $2.29 billion, beating estimates of $2.28 billion, and adjusted earnings per share of $0.80, beating estimates of $0.77, as per Finchat data.

Bernstein analyst Peter Weed reduced the price target for Palo Alto to $225 from $229 while maintaining an ‘Outperform’ rating on the stock, as per TheFly.

According to the analyst, the company showed a modest 0.7% outperformance relative to the midpoint for Q3 next-generation security annual recurring revenue (NGS ARR), which has drawn significant investor attention.

Palo Alto Networks projected its strongest sequential NGS ARR growth since launching its platformization initiative, said the analyst.

JPMorgan revised its price target, cutting it to $221 from $225 while reiterating an ‘Overweight’ rating.

In a note to investors cited by TheFly, the firm stated that although the company posted solid operating margins and met growth expectations, these positives were tempered by weaker-than-anticipated gains in net new annual recurring revenue and remaining performance obligations.

Despite these challenges, the note points to encouraging signs that agentic AI is shifting from experimental stages to real-world implementation.

The firm also noted Palo Alto’s proactive stance in AI-related cybersecurity, positioning itself as a frontrunner among platform providers preparing for widespread AI integration.

Barclays slashed its price target on Palo Alto to $210 from $213 while maintaining an ‘Overweight’ rating.

The firm noted that fiscal Q3 results were generally in line with expectations, showing stronger annual recurring revenue, though bookings for remaining performance obligations came in slightly below estimates due to a more challenging April.

Barclays expressed increased confidence in the company’s ARR growth trajectory for Q4 and fiscal 2026 (FY26) but opted to modestly lower its FY26 revenue growth estimate to 13% as a precaution.

Northland cut the price target on the stock to $177 from $210 while maintaining a Market Perform rating.

The brokerage scaled back its long-term growth outlook and no longer sees justification for forecasting growth to accelerate beyond the 17% to 19% range the company suggested early in its platformization strategy.

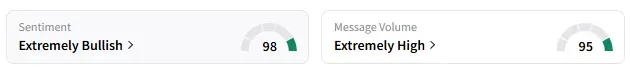

On Stocktwits, retail sentiment around Palo Alto remained in ‘extremely bullish’ territory.

A Stocktwits user hoped for a stock rebound.

Palo Alto stock added 0.7% year-to-date and 17.6% in the past 12 months.

Also See: LeddarTech Stock Gets Battered After Slashing 95% Workforce: Retail Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250352860_jpg_45946f3f12.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)