Advertisement|Remove ads.

LeddarTech Stock Gets Battered After Slashing 95% Workforce: Retail Bearish

Shares of software company LeddarTech Holdings Inc. (LDTC) plummeted 38.2% on Wednesday’s morning trade after the firm initiated temporary layoffs on Tuesday, impacting around 138 staff members companywide.

This move, which affects roughly 95% of its total workforce, is intended to reduce operational expenses as it works through ongoing financing discussions with its creditors.

The workforce reduction aligns with broader efforts to assess strategic options such as debt restructuring, asset divestitures, and filing for protection under the Companies’ Credit Arrangement Act in response to its current economic challenges.

LeddarTech remains in active discussions with Fédération des caisses Desjardins du Québec (Desjardins) and its bridge financing partners in an effort to obtain new funding or modifications to current terms within its Desjardins and Bridge credit agreements.

Thus far, these talks have not produced any finalized agreements. The company has not been asked to repay its obligations early, and negotiations are still underway.

In December 2024, LeddarTech entered into a strategic collaboration with Texas Instruments (TI), involving a software license agreement and advanced royalty payments.

This collaboration was intended to support the development of integrated platform solutions for advanced driver assistance systems (ADAS) and autonomous driving (AD) markets.

Concurrently, LeddarTech and Desjardins amended their credit facilities to temporarily postpone interest payments and adjust cash balance requirements, providing the company with additional time to secure the necessary funding.

However, as of the latest updates, these financial arrangements have not resulted in the required capital influx.

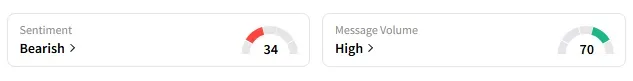

On Stocktwits, retail sentiment around LeddarTech stayed in ‘bearish’ territory.

A Stocktwits user was not happy about the news.

LeddarTech stock has lost 77.8% year-to-date and 85.6% in the past 12 months.

Also See: Baidu Rises As AI, Cloud Power Q1 Earnings: Retails Turns Extremely Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)