Advertisement|Remove ads.

AnaptysBio Stock Gets A Price Target Hike After Announcing Plan To Separate Royalty, Biopharma Businesses – Check Out The New Level

H.C. Wainwright raised its price target on AnaptysBio (ANAB) to $59 from $38 on Tuesday, following the company's announcement of its plan to split its business into two.

The analyst kept a ‘Buy’ rating on the shares. The new price target implies a potential upside of about 154% to the stock’s closing price on Monday.

AnaptysBio stated on Tuesday that its board of directors approved plans to explore separating its business into two independent, publicly traded companies. Upon completion of the split, the royalty management company will manage royalties and milestone payments from financial collaborations, including Jemperli with GSK and Imsidolimab with Vanda, with a focus on protecting and returning their value, the company said.

The royalty management company is expected to require minimal infrastructure and staff, and will operate under a new name, it added.

Meanwhile, the other company, referred to as Biopharma Co., will focus on biopharmaceutical operations, including the development and potential commercialization of innovative immunology therapeutics for autoimmune and inflammatory diseases, such as Rosnilimab, ANB033, and ANB101. After the split, Biopharma Co. will launch with adequate capital to fund operations for at least two years and will also operate under a new name, the company stated.

The separation is expected to be completed by the end of 2026. Anaptys CEO Daniel Faga is expected to continue as CEO of the biopharma company.

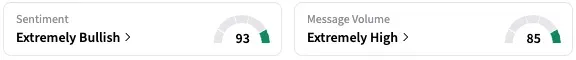

Shares of the company traded 30% higher on Tuesday afternoon at the time of writing. On Stocktwits, retail sentiment around ANAB stock rose from ‘bullish’ to ‘extremely bullish territory’ over the past 24 hours, while message volume increased from ‘normal’ to ‘extremely high’ levels.

A Stocktwits user said that they now expect the stock to crater.

ANAB stock has more than doubled this year but dropped nearly 10% over the past 12 months.

Read also: Novavax Amends Deal With Sanofi, Broadens Partnership

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_inflation_resized_f8af31ca5a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)