Advertisement|Remove ads.

Applied Digital Stock Soars 70% On $160M Nvidia-Backed Funding, Makes Retail ‘Extremely Bullish’

Applied Digital Corp. (APLD), a data-center and AI cloud company, saw its shares skyrocket more than 70% on Thursday, making it one of the top gainers in U.S. markets.

The surge followed the announcement of a $160 million private placement financing, prominently backed by AI chipmaker Nvidia Corp. (NVDA) and other notable investors, including real estate firm Related Companies.

The financing deal involves Applied Digital issuing 49,382,720 shares of its common stock at $3.24 per share, matching Wednesday’s closing price.

The infusion of capital is intended to support several ambitious projects, including the build-out of one of the world’s largest data centers and the development of an additional 300 megawatts (MW) of data center capacity, as well as expanding the company’s cloud-computing business.

Applied Digital is also reportedly seeking additional debt financing for a major data center project in North Dakota.

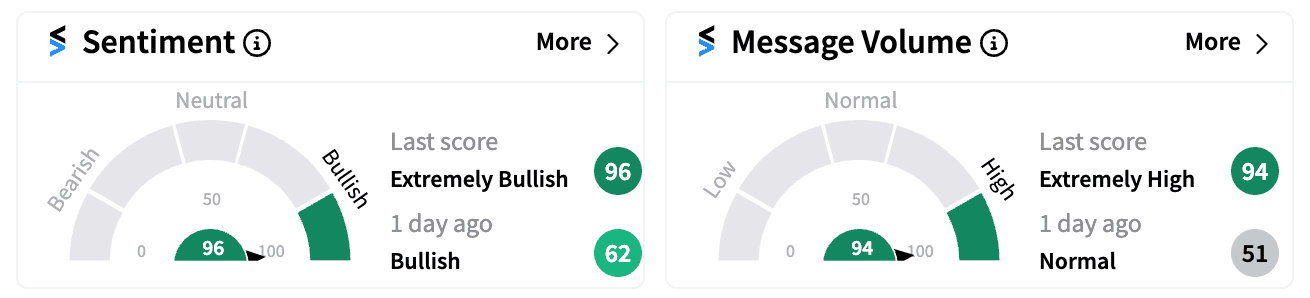

Retail investors responded enthusiastically. On Stocktwits, Applied Digital (APLD) was one of the top trending stocks, with sentiment turning ‘extremely bullish’ (96/100), the highest in over a year, accompanied by a sharp spike in message volume.

Roth MKM called the capital raise a strategically positive step for Applied Digital's two business segments. The firm maintained its Buy rating and a $10 price target on the shares, which represents nearly a 100% upside from current trading levels.

Trading volume for APLD surged to over 115.5 million, more than 25 times the daily average, and the stock broke above its 50-day moving average for the first time in more than a month.

The funding news follows a mixed fiscal Q4 report last month, where Applied Digital reported total revenues of $43.7 million, a 98% increase year-over-year, driven by expanded capacity at its data center hosting facilities and the launch of its cloud services segment.

However, the company’s Q4 adjusted loss of $0.36 per share was worse than feared, impacted primarily by a transformer issue that caused a power outage at one of its data centers for much of the quarter.

Applied Digital stock is down nearly 24% year-to-date, reflecting broader concerns over operational setbacks and a challenging macro environment.

However, the new capital injection and strategic backing from Nvidia could be pivotal in reshaping the company's trajectory and enhancing its competitive position in the rapidly growing AI and cloud-computing sectors.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)