Advertisement|Remove ads.

Apple Analyst Says Trump Tariffs ‘Devastating’ For Tech Giant, Cuts Street-High Price Target: Retail Pessimism Persists

Apple, Inc. (AAPL) shares are on track to fall for a third straight day as investors deemed the tech giant one of the worst hit by President Donald Trump’s reciprocal tariffs.

A bullish analyst, who had a street-high price target for the stock, tempered his opinion on Sunday, citing tariff uncertainty.

Wedbush analyst Daniel Ives reduced the price target for Apple stock to $250 from $325 but maintained an ‘Outperform’ rating. The new price target still meant nearly 33% upside from the stock’s beaten-down level.

The analyst said the tariffs are a complete disaster for Apple due to its massive exposure to China's production. “In our view, no US tech company is more negatively impacted by these tariffs than Apple with 90% of iPhones produced and assembled in China,” he added.

According to the analyst, the current tariff slate of 54% for China and 32% for Taiwan would devastate Apple, its cost structure, and consumer demand.

Although Apple has diversified its supply chain to other parts of the world, including Vietnam, India, and the U.S., China produces the vast majority of iPhones, over 50% of Mac products, and 75-80% of iPads, the analyst said.

Ives does not expect Apple to provide guidance on the March quarter earnings call, given the prevalence of too much uncertainty. Assuming the tariffs in their current form will stick around for a few months, the analyst reduced his estimates for Apple and, in turn, lowered the price target.

Separately, Bloomberg columnist Mark Gurman said in his weekly “Power On” newsletter that Apple may have to raise U.S. iPhone prices due to the tariffs. He noted that Vietnam, where the company makes AirPods, iPads, Apple Watches, and Macs, is hit with a 46% levy, Malaysia, where it produces Macs, has a 24% tariff rate, and India, which is increasingly building iPhones, and AirPods, has a 26% tariff rate.

The Apple leaker said the overall picture suggested Apple wasn’t benefiting much from diversifying away from China.

A separate Exame report said Apple is contemplating expanding iPhone assembly in Brazil as a workaround to tariffs. Brazilian exports invite only the baseline tariff rate of 10%.

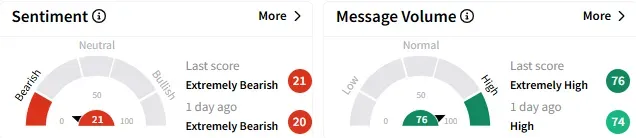

On Stocktwits, retail sentiment toward Apple stock stayed ‘extremely bearish’ (21/100), and the message volume perked up to ‘extremely high’ levels.

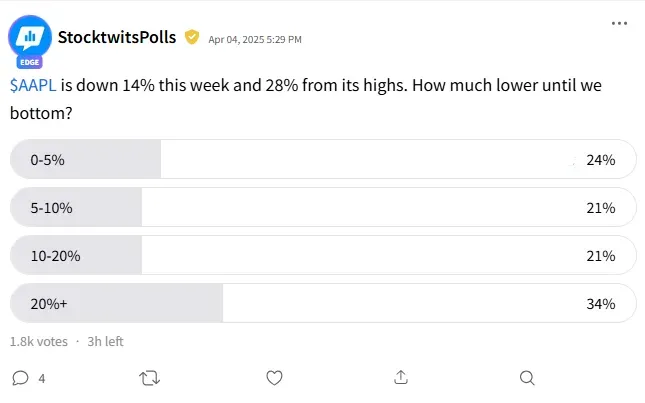

An ongoing Stocktwits poll showed that almost a third of the respondents (34%) firmly believe Apple's stock may have a further downside from its current levels.

Meanwhile, 21% each predicted a 5-10% and 10-20% downside.

Only about a quarter of the respondents (24%) said the stock may have bottomed or will hit a bottom with up to 5% downside from current levels.

A bearish watcher raised the specter of a drop below the $150 level.

Notwithstanding the recent drop, another user considers the valuation “crazy high.”

Apple stock fell 2.54% to $183.59 in Monday’s premarket trading. The stock is down about 25% from the start of 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)