Advertisement|Remove ads.

Apple To Witness Slower Shipment Growth Amid Uncertain Tariff Future, Says Counterpoint Research: Retail’s Cautious

Counterpoint Research significantly lowered its 2025 shipment growth projections for Apple on Wednesday, pointing to ongoing instability in U.S. trade policy as a key factor.

The firm adjusted its projections for worldwide smartphone shipments in 2025, lowering its year-over-year growth forecast from 4.2% to 1.9%.

The outlook suggests modest gains in most global markets, but North America and China are expected to drag down overall figures due to pricing pressure and tepid consumer response to government incentives.

North America is projected to face a downturn, largely attributed to anticipated cost hikes passed on from manufacturers due to trade duties.

Meanwhile, the Chinese market is now expected to deliver little to no growth, following a lackluster response to the state-backed subsidy program aimed at reviving demand.

Counterpoint said that both Apple and Samsung may be compelled to raise prices, which could reduce consumer interest, even though the tariff impact is slightly less severe than initially feared.

Despite the overall slowdown, Huawei Technologies has emerged as a standout due to improvements in component availability and momentum from its in-house chip development.

Associate Director Liz Lee highlighted that although demand has softened in several Western and Asian markets, Apple is still expected to see growth from its iPhone 16 lineup, particularly in emerging economies such as India, the Gulf Cooperation Council (GCC), and Southeast Asia.

She added that consumer interest in premium models remains a positive driver across these regions.

With an unpredictable trade environment looming, Counterpoint emphasized that pricing strategies and logistics planning remain vulnerable, possibly shifting again if global trade rhetoric intensifies.

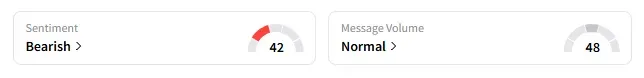

On Stocktwits, retail sentiment around Apple remained in ‘bearish’ territory.

Apple stock has lost over 18% in 2025 and has added over 4% in the past 12 months.

Also See: Fortinet Builds Cyber Defense For Every Click, From Email To Slack: Retail’s Yet To React

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)