Advertisement|Remove ads.

Artelo Biosciences Stock Doubles After Positive Results In First Non-Opioid Pain Treatment Trial

Shares of Artelo Biosciences, Inc. (ARTL) more than doubled on Monday after the company announced favorable results from its first in-human study evaluating ART26.12, a non-opioid treatment candidate for persistent pain.

ART26.12 is being developed as a novel, peripherally acting, non-opioid, non-steroidal analgesic. The initial clinical development planned is for chemotherapy-induced peripheral neuropathy (CIPN). CIPN is nerve damage caused by certain chemotherapy drugs, leading to sensory, motor, or autonomic dysfunction.

The company said that all adverse events identified during the in-human trial were mild, transient, and self-resolving. Furthermore, the study demonstrated predictable pharmacokinetics for the drug.

Pharmacokinetics is defined as the quantitative analysis of the processes of drug absorption, distribution, and elimination that determine the time course of drug action in response to an administered drug dose.

The company said that complete dose-exposure profiles were explored, and tests confirmed dose-dependent, linear absorption across the evaluated range.

Andrew Yates, Chief Scientific Officer at Artelo, said that the company is “particularly pleased” that the safety and pharmacokinetic profile generated from ART26.12’s non-clinical studies translated well to the human experience.

According to Artelo, the chronic pain therapeutics market exceeded $97 billion globally in 2023 and is expected to surpass $159 billion by 2030, driven by the increasing prevalence of conditions such as neuropathic pain, arthritis, and fibromyalgia.

The company said that a multiple ascending dose study to evaluate the safety, tolerability, and pharmacokinetics of ART26.12 with repeated dosing over time is expected to commence in the fourth quarter this year.

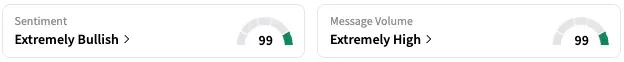

On Stocktwits, retail sentiment around ARTL jumped from ‘bearish’ to ‘extremely bullish’ over the past 24 hours while message volume rose from ‘normal’ to ‘extremely high’ levels.

A Stocktwits user, however, flagged that the company will need cash to progress its pipeline, and hence, dilution is likely.

The company had cash and investments totaling only $0.7 million as of the end of the first quarter.

ARTL stock is up by about 135% this year and by about 85% over the past 12 months.

Read Next: Tesla Q2 Deliveries Expected To Fall Below Consensus, JPMorgan Underscores A ‘Sizable’ Shortfall

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)