Advertisement|Remove ads.

ASML Stock Draws Maximum Jump In Retail Eyeballs As Analysts Get Bearish On Gloomy Outlook

U.S.-listed shares of ASML Holding NV ($ASML) were up nearly 3% as of 1:15 p.m. ET on Thursday, despite a cautious outlook that has weighed on the stock.

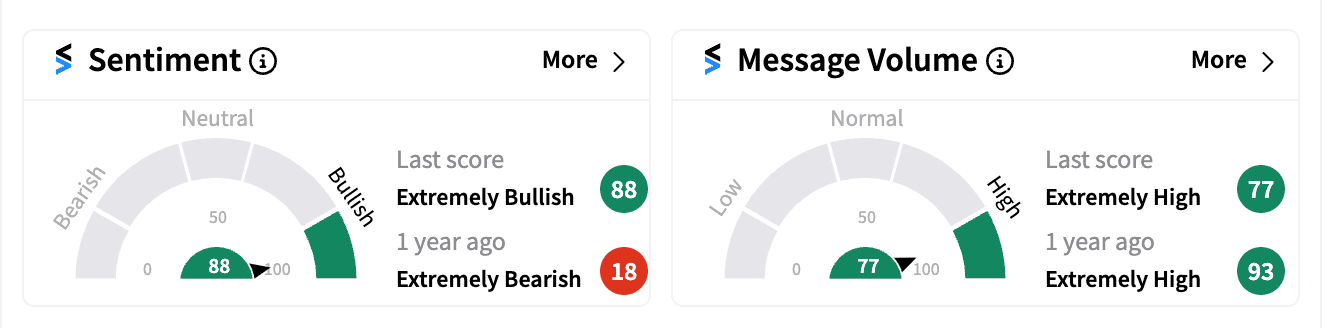

ASML became the top symbol with the most new watchers on Stocktwits in the last 24 hours, with sentiment turning ‘extremely bullish’ from ‘extremely bearish’ a day ago.

The Dutch semiconductor equipment-maker warned on Wednesday that recovery in parts of the chip industry could be delayed into 2025, sparking fears of a prolonged downturn.

This outlook hit AI chip stocks like Nvidia and AMD, along with major tech names like Apple, Microsoft, and Google.

ASML stock has lost around 20% since the warning, with its market cap now near $269 billion.

Several bearish analyst calls followed. DZ Bank downgraded ASML to Hold with a price target of EUR 650.

Wells Fargo cut its price target from $1,000 to $790 but maintained an ‘Overweight’ rating, citing a reset of expectations and looking ahead to the company’s November CMD event for signs of recovery in 2026.

Morgan Stanley lowered its price target to EUR 680, noting that market challenges have arrived earlier than expected and that investor focus has shifted to non-China deep ultraviolet (DUV) lithography targets and potential shifts in pricing negotiations with key customers like TSMC.

Retail interest in ASML surged on Stocktwits, with a jump of 11% in its following and a massive 6400% increase in message volume.

Year-to-date, ASML shares are down more than 2%, underperforming broader indices.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203832456_jpg_44d98cfd46.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2190610032_jpg_24be969647.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rambus_jpg_24a70e2cdf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230318507_jpg_7da87b5f7a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)