Advertisement|Remove ads.

Nvidia Stock Recovers While Apple, Microsoft Still Struggle After ASML Shock: Retail Sentiment Stays Weak

Shares of ASML took another hit on Wednesday, dropping 6% after a staggering 16% plunge the day before. This turmoil follows the unexpected early release of the company's third-quarter earnings, which revealed disappointing forecasts that have left investors on edge.

ASML's struggles continue to weigh on tech stocks, with Apple Inc. (AAPL) and Microsoft Corp. (MSFT) still down about 1%, though both show signs of recovery. In contrast, Nvidia Corp. (NVDA) has rebounded nearly 2% following a 4.7% drop yesterday.

All three companies are competing to reach the $4 trillion market cap, driven by the buzz surrounding artificial intelligence (AI). Apple currently leads the pack with a market capitalization of $3.56 trillion.

Nvidia started the week with strong momentum, closing the gap to just $150 billion, but that difference has since doubled. It now trails behind by $330 billion, bringing its market cap to $3.23 trillion. Meanwhile, Microsoft lags behind the two with a market cap of $3.11 trillion.

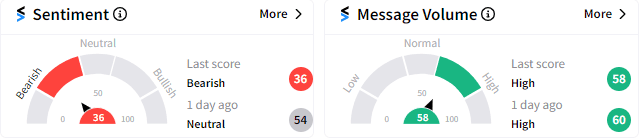

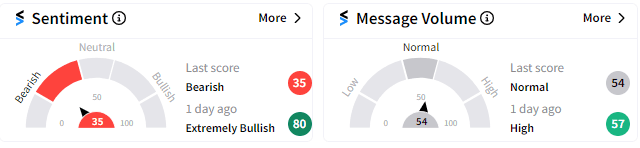

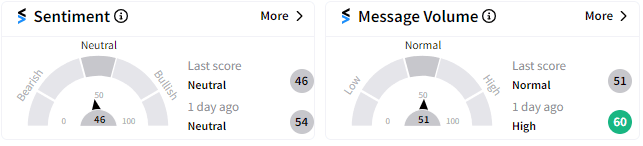

Retail sentiment on Stocktwits for all three companies continues to lag after the hit they took on Tuesday.

Retail sentiment surrounding Nvidia has slid deeper into the ‘bearish’ zone (36/100), shifting from a neutral stance just a day earlier.

Apple's retail sentiment has plummeted to ‘bearish’ (35/100) after previously enjoying an ‘extremely bullish’ rating (80/100) just one day ago.

Microsoft's retail sentiment holds steady in the ‘neutral’ range (46/100), indicating no significant change from the previous day.

Other chip stocks have recovered slightly on Wednesday as well. Advanced Micro Devices Inc. (AMD) is showing a modest gain after its 4.8% tumble, while Broadcom and Taiwan Semiconductor Manufacturing Company (TSMC) have also edged up slightly, each gaining around 1% after declines of 3.7% and 2.6%, respectively.

For updates and corrections email newsroom@stocktwits.com.

Read more: Abbott Labs Stock Dips Pre-Market On Narrowed Profit Outlook: Retail Turns Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)