Advertisement|Remove ads.

ASML Stock In The Spotlight Following An Analyst U-Turn — Here’s What’s Driving The Double Upgrade

- Aletheia Capital significantly boosted ASML’s fiscal 2026 and 2027 earnings estimates, citing the company’s investment expansions and capacity upgrades, according to TheFly.

- The analyst noted stronger demand for extreme ultraviolet lithography from DRAM suppliers as one of the reasons it believes ASML will post higher earnings.

- It also highlighted resilient orders for deep ultraviolet from China and a potential surge in TSMC demand in fiscal 2027 as reasons for higher earnings potential for the company.

ASML Holding (ASML) garnered attention after Aletheia Capital doubled its price target and simultaneously upgraded the stock.

Aletheia Capital’s analyst Warren Lau upgraded ASML stock to ‘Buy’ from a previous ‘Sell’ rating and increased the price target on the company to $1,500, up from $750 before, according to TheFly.

Shares of ASML climbed over 4.8% in Friday’s pre-market trade.

Capacity Expansion And Investments

The analyst significantly boosted ASML’s fiscal 2026 and 2027 earnings estimates, citing the company’s investment expansions and capacity upgrades.

ASML will post higher earnings due to stronger extreme ultraviolet lithography demand from DRAM suppliers, resilient deep ultraviolet orders from China, and a potential surge in TSMC demand in fiscal 2027, Aletheia Capital told investors in a note, according to TheFly.

The optimistic upgrade and comments come even as China limits the use of foreign equipment for chip manufacturers.

China Impact

ASML is the world’s most crucial supplier of photolithography machines, which are critical for manufacturing advanced semiconductors. China is an important market for ASML and made up about 36% of sales in 2024, according to an earlier Reuters report.

However, China is reportedly making it mandatory for chipmakers in the country to use at least 50% domestically produced equipment for new capacity, with a goal of eventually reaching 100%. While China is reportedly relaxing these requirements where domestically developed equipment is not yet available, the country is making strides in chip technology development.

Another report from Reuters alleged that Chinese scientists are testing a prototype EUV lithography machine reverse-engineered by former ASML engineers, suggesting the Asian country may be moving toward semiconductor self-sufficiency faster than the world may have expected. Until now, only ASML has mastered this technology.

In the most recent quarterly update, ASML’s President and Chief Executive Officer, Christophe Fouquet, also noted that the company expects China’s net sales in 2026 to decline significantly compared to previous years.

How Did Stocktwits Users React?

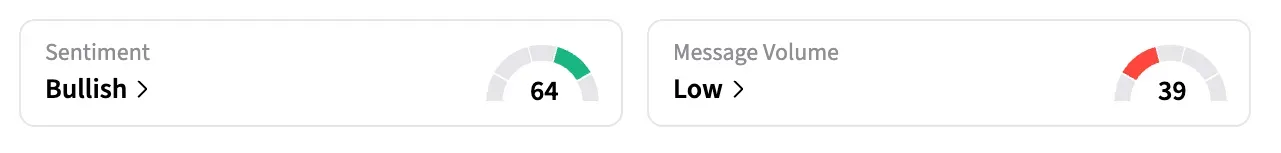

On Stocktwits, retail sentiment around ASML stock remained in the ‘bullish’ territory over the past day amid ‘low’ message volumes.

One bullish user noted Aletheia Capital’s complete turnaround on the stock due to a new wave of EUV investment.

Shares of ASML climbed over 52% in the last year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)