Advertisement|Remove ads.

AST SpaceMobile’s Extraordinary Year Didn’t Come Easy — The Next Satellite Launch May Decide Whether This Rally Has Real Legs

- Revenue growth is explosive but inconsistent, losses remain deep, and valuation far exceeds listed peers on a price-to-sales basis.

- High short interest, though easing from peaks, leaves ASTS vulnerable to sharp volatility or a short squeeze if launches or partnerships deliver positive surprises.

- Retail sentiment is bullish, shorts remain elevated, but analysts warn that valuation risk outweighs near-term upside despite the upcoming BlueBird 6 launch.

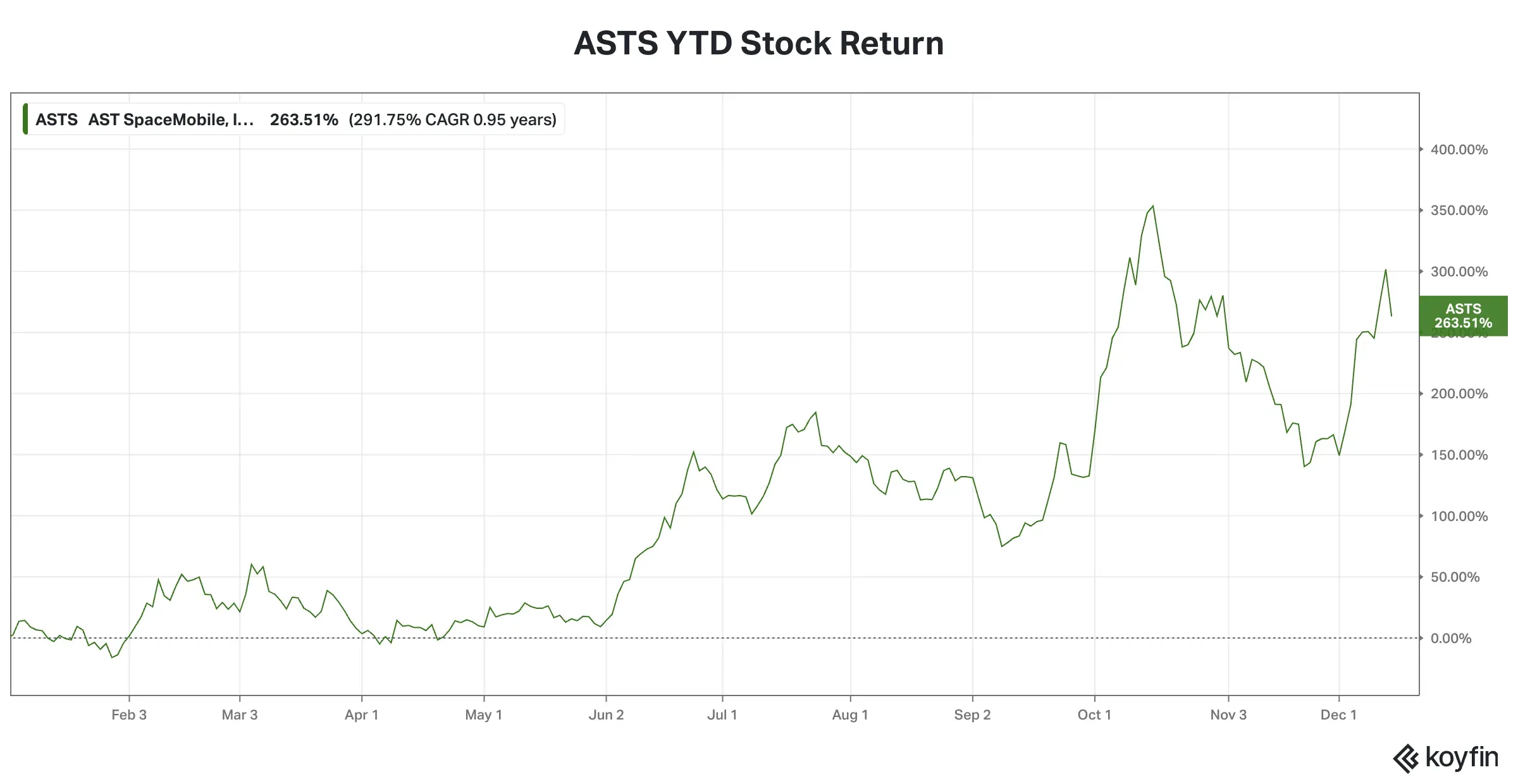

While speculation swirls around Elon Musk–owned SpaceX’s potential IPO, another space stock quietly delivered a record rally—even as fundamental challenges lingered. AST SpaceMobile’s stock had a stellar year, rising to an all-time high of $102.97 despite the satellite communications company experiencing delays in building and launching satellites.

The company is under pressure to scale up quickly as competition breathes down its neck, while the capital-intensive nature of its business has put pressure on its liquidity.

ASTS’s BlueBird 6 Hiccup

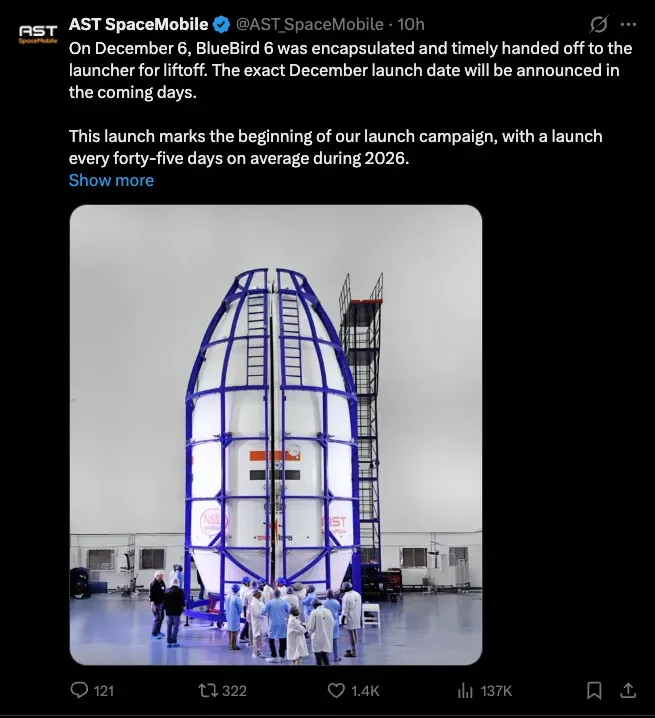

The launch of the first of ASTS’s next-generation BlueBird 6 satellite — its next significant catalyst — has been pushed back from the originally planned Dec. 15 to Dec. 21. The Indian Space Research Organisation (ISRO), which has been managing the launch, has reportedly communicated the delay, citing prolonged prelaunch activities.

ASTS, meanwhile, confirmed on its X handle that BlueBird 6 was encapsulated and handed off to the launcher on Dec. 6 for liftoff, and that the exact December launch date will be announced in the coming days.

“This launch marks the beginning of our launch campaign, with a launch every forty-five days on average during 2026,” the company said.

BlueBird 6 is the first of ASTS’s next-generation satellites. According to the company:

“When launched, it will feature the largest commercial phased array in low Earth orbit at nearly 2,400 square feet. This represents a 3.5 times increase in size over BlueBirds 1-5 and supports 10 times the data capacity.”

ASTS’s Risk-Reward Profile

AST SpaceMobile operates in a high-growth, high-risk industry, with the company touring its total addressable market (TAM) at $1 trillion and potential subscribers at about 3 billion.

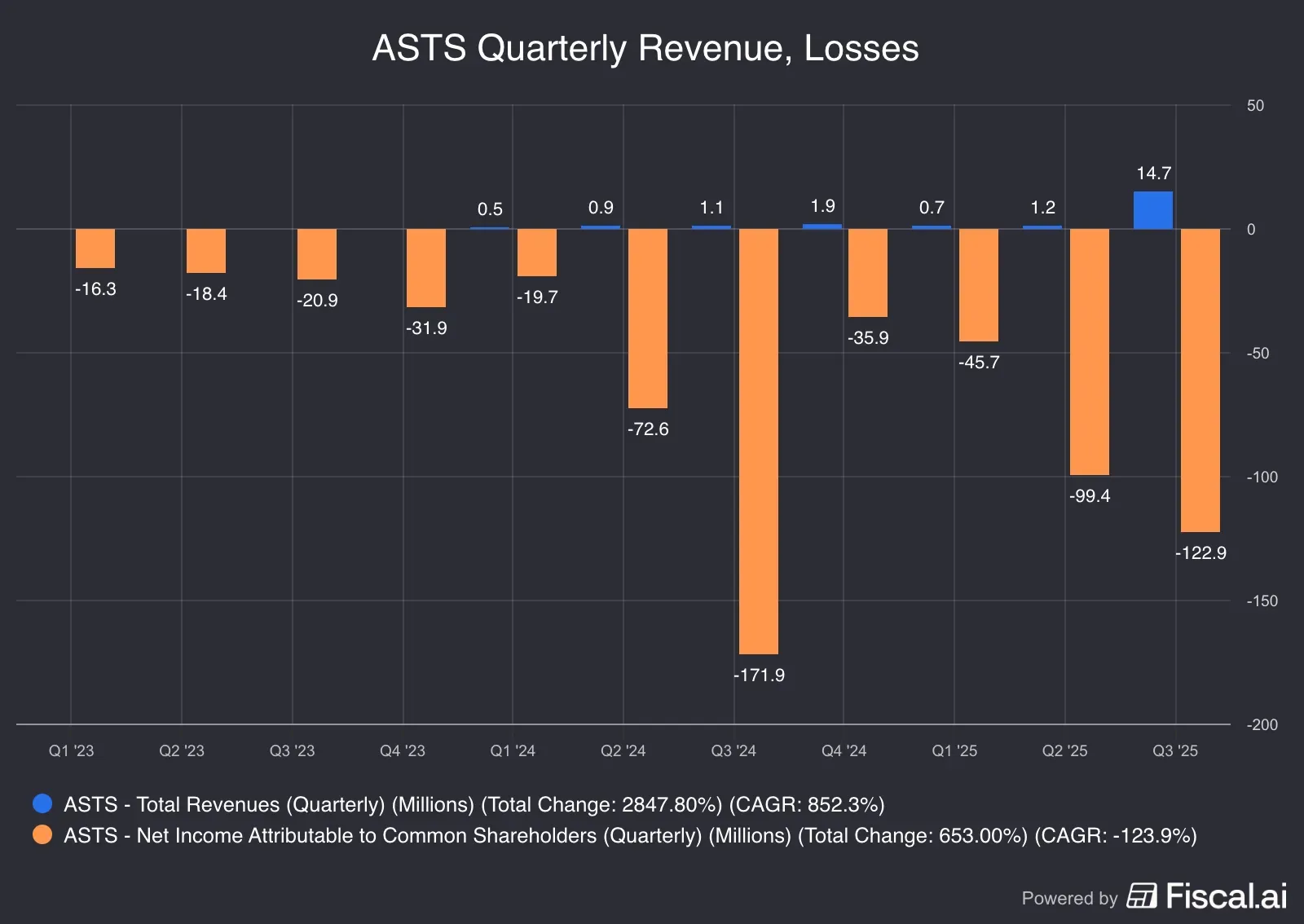

Its revenue rose a whopping 1,240% year-over-year to $14.74 million in the third quarter ended on Sept. 30, 2025, yet it missed the consensus estimate. The topline has trailed expectations in each of the past four quarters. It continues to rake in huge losses as operating expenses rise.

Source: Fiscal.ai

ASTS generates revenue through wholesale service agreements with mobile network operators such as AT&T, Verizon, Vodafone, etc, with carriers providing satellite service as an add-on to their plans. Revenue is shared equally between the two parties. It also gets revenue from federal contracts. The company has the potential to generate subscription-based revenue by providing seamless space-based voice, data, and video to users in a dead zone.

A Pricer Stock

Compared with its publicly listed rivals, ASTS commands a hefty price-to-sales (P/S) valuation. Its P/S ratio is 124.84 compared to 32.61 for Globalstar and 2.23 for Iridium communication. SpaceX’s valuation, by the same measure, would be 25.1 times, considering a valuation of $400 billion, according to Morgan Stanley’s August report. Musk-led SpaceX’s valuation based on the latest insider stock sales is reportedly $800 billion, but it is also said to be aiming for a $1.5 trillion valuation if it goes public.

Source: Koyfin

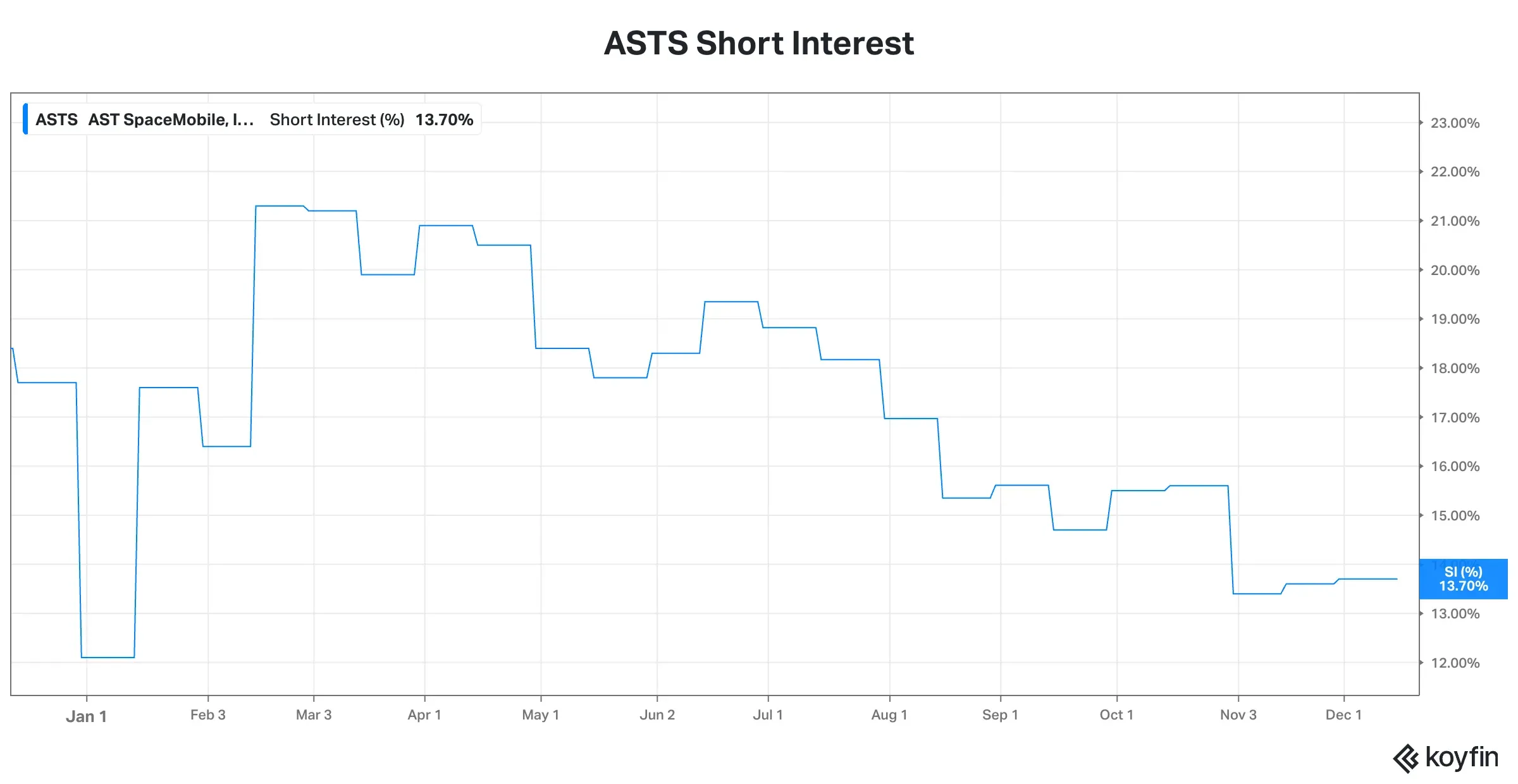

The short interest in ASTS’ stock is relatively high, although the short percent has declined from the March peak of over 21%, making it an ideal candidate for a squeeze if there is positive news flow down the line.

Source: Koyfin

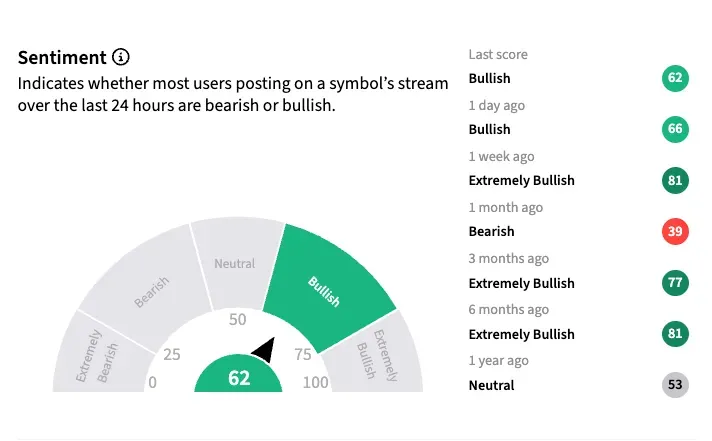

Retail Upbeat, Analysts Wary

AST SpaceMobile stock elicited a ‘bullish’ reaction from among Stocktwits’ retail users as of early Monday. Retail mood, however, tempered from an ‘extreme bullish’ stance seen a week ago.

According to Koyfin, the average analyst price target for AST SpaceMobile stock is $71.51, implying a downside of nearly 7% from current levels. More than half of the analysts covering the stock either remain on the sidelines or are bearish.

Bearish analysts are mainly concerned about valuation. When Barclays double-downgraded the stock in mid-October, the firm said the direct-to-cellular segment would be a "very attractive opportunity" and that AST has key assets to succeed, The Fly reported. Still, the stock's valuation "has become excessive,” the firm said.

With stock pulling back from its October peak and bottoming in late November, Scotiabank upgraded it to ‘Sector Perform’ from ‘Underperform’ and maintained the price target at $45.60. But since then, the stock has trended higher.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: For Rivian, 2025 Is A Comeback Year — But Can Its Stock Continue To Outrun Tesla With Big AI Bets?

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)