Advertisement|Remove ads.

180 Life Sciences Turns Retail Heads With Online Gaming Entry, Stock Surges 500%

Shares of 180 Life Sciences Corp. ($ATNF) surged more than 500% on Wednesday, becoming the top gainer across U.S. exchanges, boosting retail sentiment.

The sharp rally followed the company’s announcement of its strategic pivot into online gaming, or iGaming, a move that has sent retail investors into a frenzy.

In a letter to shareholders, interim CEO Blair Jordan revealed that 180 Life Sciences plans to enter the global iGaming market using a newly acquired blockchain-based gaming platform, which supports cryptocurrency transactions.

Initially, the company will focus on B2C online casinos, with plans to expand into a B2B model that will provide blockchain-enabled technology solutions to gaming operators worldwide.

180 Life highlighted that it sees attractive acquisition opportunities within the iGaming industry, leveraging the company’s Nasdaq listing to consolidate private gaming firms.

“We hope that this liquidity advantage will allow 180 to acquire private gaming companies at attractive valuations,” the company stated, though no immediate acquisitions are planned as it continues conducting preliminary diligence.

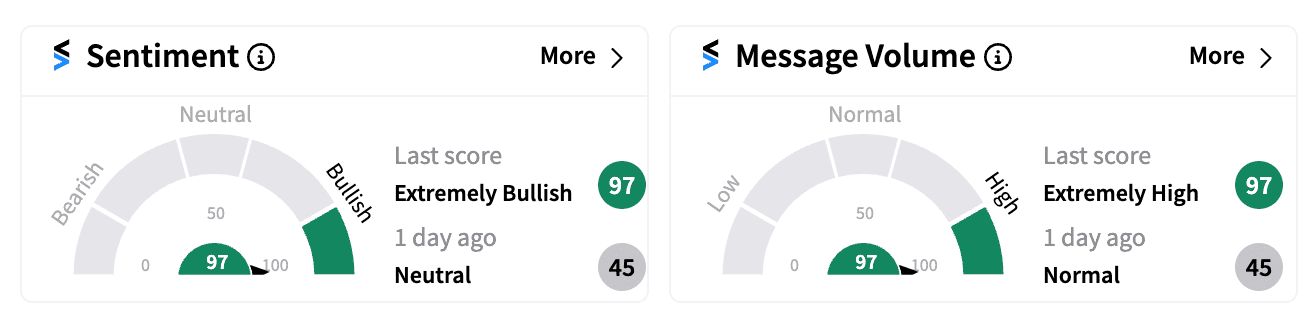

Retail investors responded enthusiastically on Stocktwits, where sentiment shifted to ‘extremely bullish’ (97/100) from ‘neutral’ just a day prior.

180 Life Sciences confirmed last week that it had regained compliance with Nasdaq’s minimum stockholders’ equity requirement, a crucial step that enables it to focus on its iGaming expansion while continuing to advance its biotechnology programs.

Earlier this month, the company reported progress on its synthetic CBD analogs (SCAs), designed as safer, more effective alternatives to unregulated CBD products.

Year-to-date, the stock is up more than 165%. The company's current market cap is under a million dollars.

Read next: Novavax Stock Tanks After FDA’s Clinical Hold On Vaccine Candidates: Retail Turns Jittery

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2238161001_jpg_d763653491.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202902434_jpg_34a840ada1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_CZ_ZHAO_OG_2_jpg_f6124171e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248471134_jpg_9957fc576c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)