Advertisement|Remove ads.

Novavax Stock Tanks After FDA’s Clinical Hold On Vaccine Candidates: Retail Turns Jittery

Shares of Novavax ($NVAX) plunged 20% early on Wednesday after the biotech company disclosed that the U.S. FDA placed a clinical hold on its Investigational New Drug (IND) application for two vaccine candidates: its COVID-19-Influenza Combination (CIC) and a stand-alone influenza vaccine.

The clinical hold was triggered by a report of a serious adverse event (SAE) involving motor neuropathy in a participant from a CIC Phase 2 trial conducted outside the U.S.

The participant, who received the vaccine in January 2023, reported the SAE in September 2024 — well after the trial’s completion in July 2023.

Novavax emphasized that previous trials of its COVID-19 and influenza vaccines showed no signs of motor neuropathy, and it is working closely with the FDA to resolve the issue.

The company’s Chief Medical Officer, Robert Walker, MD, reassured stakeholders that safety remains their top priority.

“While we do not believe causality has been established for this serious adverse event, we are committed to working expeditiously to fulfill requests for more information from the FDA. Our goal is to successfully resolve this matter and to start our Phase 3 trial as soon as possible,” he said.

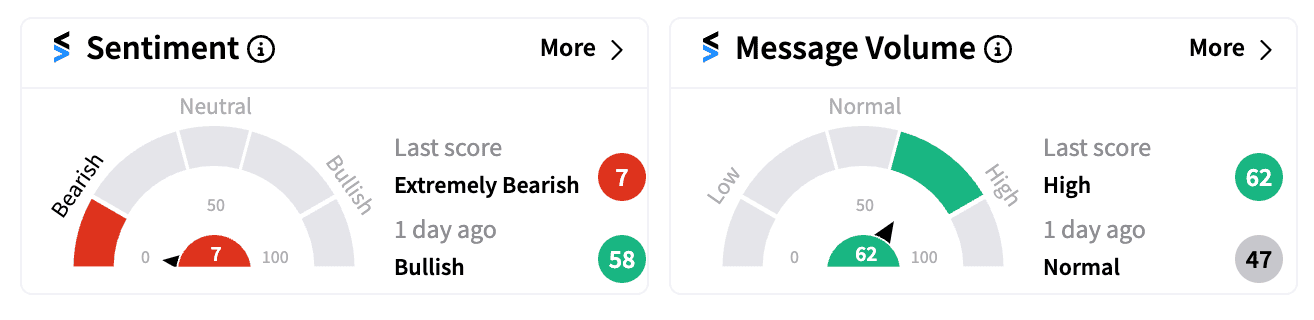

Retail sentiment for NVAX swiftly turned ‘extremely bearish’ (7/100) on Stocktwits, to its lowest level in a year, with many traders expressing concerns.

The company’s stock, which has more than doubled so far this year, is facing increased scrutiny, especially given its high-stakes $1.2 billion licensing deal with Sanofi ($SNY).

That partnership aims to commercialize a combined COVID-19 and flu shot, with Novavax set to receive $500 million upfront and an additional $700 million contingent on development and regulatory milestones.

Despite missing out on the early COVID-19 vaccine race to competitors like Pfizer-BioNTech and Moderna, Novavax is still aiming to capitalize on the next phase of vaccine demand.

The company is expected to report third-quarter earnings in November, having missed Wall Street EPS estimates in two of the last four quarters.

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2049107660_jpg_906b4acd1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203496924_jpg_18e024f0e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2195819624_jpg_841341254c.webp)