Advertisement|Remove ads.

Aurinia Stock Jumps After Firm Restructures Board, Rejects CEO Peter Greenleaf’s Conditional Resignation: Retail Sentiment Improves

Aurinia Pharmaceuticals (AUPH) said on Thursday it has restructured its board of directors to further align the company with shareholder interests. Shares of the firm were trading over 5% higher in Friday’s pre-market session as of 6:39 a.m. ET.

Aurinia said its CEO and President Peter Greenleaf had conditionally resigned as a director because he received less than majority support at the firm’s 2024 annual general meeting. The firm explained that after careful consideration by the board, it came to a conclusion that there are exceptional circumstances that warrant the rejection of Greenleaf’s conditional resignation.

“The board believes that maintaining Mr. Greenleaf’s director position is in the best interests of the company and allows for the company’s continued focus on commercial execution, free cash flow generation, and advancement of its pipeline,” it said. As a result, Greenleaf will continue to remain as a director, it said.

At the same time, the board appointed Kevin Tang, President of Tang Capital Management, a life sciences-focused investment company, as a director. Tang has over 20 years of experience investing in, governing and leading companies in the biopharmaceutical industry, the firm noted.

Meanwhile, Aurinia’s board accepted the conditional resignations of Daniel G. Billen, R. Hector MacKay-Dunn, and Brinda Balakrishnan, who received less than majority support at the meeting. The newly restructured board consists of seven members that include Jeffrey A. Bailey, Robert T. Foster, Peter Greenleaf, David R.W. Jayne, Jill Leversage, Karen Smith, and Kevin Tang.

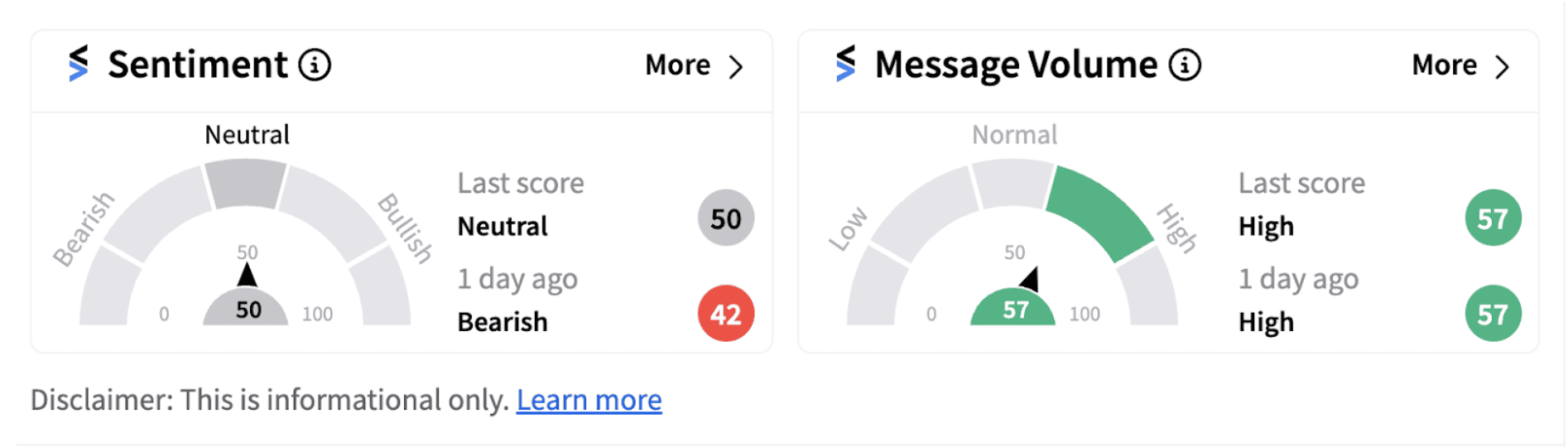

Following the announcement, retail sentiment on Stocktwits inched-up into the ‘neutral’ territory from the ‘bearish’ zone a day ago, accompanied by ‘high’ message volumes.

Recently, H.C. Wainwright reiterated its ‘Buy’ rating on the stock with a $13 price target. The stock is currently trading near the $6.5 mark and recently crossed above its 200-day moving average.

Although this could be considered by many as a positive sign, it is notable that the shares are still down over 80% from their highs in Nov. 2021. With the latest board restructuring in place, investors will be keenly evaluating the firm’s performance in the coming quarters.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)