Advertisement|Remove ads.

Autodesk Says Willing To Review Starboard Slate As Proxy War Heats Up: Retail Mood Worsens

Autodesk, Inc. (ADSK) shares climbed on Wednesday after activist investor Starboard confirmed a proxy war against the design software maker. Responding to Starboard’s publicly released letter, the company said it would review the rival slate of directors if it goes ahead with director nominations.

In a statement released after the market closed, San Francisco, California-based Autodesk confirmed the receipt of Starboard’s letter.

The company said if Starboard proceeds with its nomination, the board’s Corporate Governance Committee will review its candidates as part of the regular director evaluation process. It also asked its shareholders not to take any action at this time.

Starboard’s stake in Autodesk is currently valued at over $500 million.

The company also clarified that the activist investor did not take any action last year when it offered an opportunity to participate in the new director election process. It also noted that it proactively met with Starwood representatives repeatedly last year, inviting them to present ideas to the full board.

Meanwhile, in the letter signed by Managing Member Jeffrey Smith, Starboard took exception to Autodesk’s decision to offer clarity on the impact of the recently announced job cuts at the Investor Day to be held in the third quarter. It added that the event would come well after the annual shareholder meeting.

The activist investor claimed in the letter that there is a substantial margin improvement opportunity at Autodesk. The firm said the fiscal year 2026 guidance does not make sense in light of the 9% workforce reduction recently and that the company should shoot for 45% adjusted operating margins by the fiscal year 2028.

Starboard also called for board changes to ensure accountability for value creation.

Replying to issues raised by Starboard, Autodesk said it has been taking decisive actions to drive growth, significantly expand operating margin, generate robust cash flow and continue innovating for customers.

The company also said it has a proven track record of board refreshment and strong corporate governance.

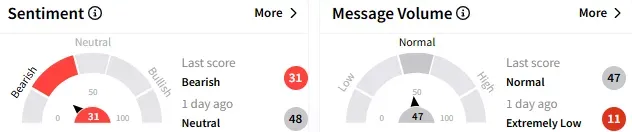

On Stocktwits, retail sentiment toward Autodesk stock reverted to ‘bearish’ by the end of Wednesday’s session from the ‘neutral’ mood that prevailed a day ago. The message volume was ‘low.’

Autodesk ended Wednesday’s session up 3.21%at $268.30. The stock has lost about 10% so far this year.

For updates and corrections email newsroom[at]stocktwits[dot]com.

Read Next: CrowdStrike Analyst Dismisses Alphabet-Wiz Threat, But Retail Sees Some Risks

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Wingstop_jpg_0737a8a046.webp)