Advertisement|Remove ads.

AvidXchange Reportedly Weighing A Sale After Takeover Interest, Retail Chatter Spikes

AvidXchange Holdings (AVDX) stock garnered retail attention on Thursday after a Bloomberg report said the financial technology (fintech) firm was weighing a possible sale after getting takeover interest.

The report, citing people familiar with the matter, said the company has been working with adviser Financial Technology Partners to consider options after potential buyers, including private equity firms, approached it in recent months for a buyout.

The report added that AvidXchange might opt to not proceed with a sale, particularly given the recent turmoil in the equity markets.

The company’s shares rose nearly 14% on Thursday, resulting in a market valuation of $1.6 billion.

AvidXchange had topped quarterly earnings and revenue expectations in February, helped by an increase in the number of transactions it processed. The company helps midsize businesses settle bills.

The Charlotte, North Carolina-based company forecast 2025 revenue between $453 million and $460 million and adjusted earnings in the range of $0.25 to $0.27 per share.

However, several brokerages had cut the stock’s rating and considered its outlook disappointing.

According to TheFly, KeyBanc analysts noted that macro challenges and a softer 2024 exit rate of customer additions is folded into the outlook, adding "further scrutiny" to the AvidXchange growth algorithm.

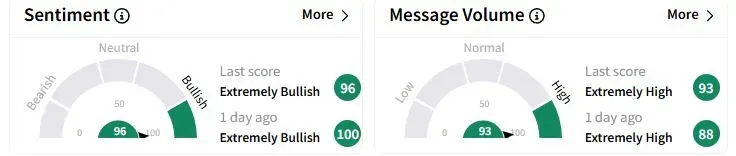

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ (96/100) territory while retail chatter was ‘extremely high.’

One user said it might not be prudent for the CEO to sell the company now. The trader also said that larger fintech peer Corpay might be interested in acquiring the company.

Over the past year, AvidXchange stock has fallen 39.2%.

Also See: FreightCar Stock Gets Retail Buzzing On Q4 Earnings Beat

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_stock_jpg_770e12377f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2225995334_jpg_67de820c56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_CRCL_resized_jpg_eafa0166a7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_oil_neww_a4e4f5f75e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Boeing_jpg_48e7f3f6e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)