Advertisement|Remove ads.

Axis Bank Stock: SEBI Analyst Sees Breakout Potential Above This Level

Axis Bank shares have shown a rebound from support near ₹1,045–₹1,050, though it remains under pressure below key moving averages. While technical indicators show mixed signals, SEBI-registered analyst Deepak Pal believes strong fundamentals and stable asset quality could keep the long-term uptrend intact.

Weekly Technical Watch

Deepak Pal noted that Axis Bank stock traded around the 20-day Exponential Moving Average (EMA) at ₹1,115 and just under the 50-day EMA of ₹1,125, while the 100-day EMA of ₹1,165 acted as strong resistance. The 200-day EMA of ₹975 provides long-term support, keeping the broader uptrend intact.

Other technical indicators were mixed, with the Relative Strength Index (RSI) at 49 showing neutral momentum. MACD was still negative but flattening, and Parabolic SAR dots above price suggested that the bears still held the edge.

Going ahead, a breakout above ₹1,130 could push Axis Bank towards ₹1,165–₹1,200, while a failure to sustain these levels may lead to a retest of ₹1,050 and even ₹975, according to Pal.

Fundamental View

Axis Bank is one of India’s leading private sector banks with diversified operations in retail banking, corporate lending, SME finance, wealth management, and treasury services.

Pal said that its strong brand equity and a wide distribution network (branch + digital) provided a competitive advantage. It reported stable credit growth in June quarter (Q1 FY26) earnings, though margins (NIMs) were under pressure due to the high cost of deposits.

Asset quality has improved with the gross non-performing asset ratio below 2%, which was a significant positive compared to past cycles. Pal added that its recent fundraising and strong capital buffers support expansion plans.

Triggers To Watch

The Reserve Bank of India’s (RBI) interest rate policy is key; FY26 rate cuts could compress margins, while stable policy supports growth without major pressure. Additionally, any global risk (crude prices, currency volatility, slowdown) and regulatory changes may impact profitability. Q2 results could show credit growth despite margin pressure; asset quality will be a key focus.

What Is The Retail Mood?

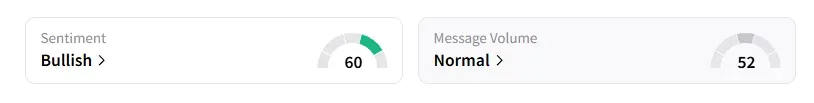

Data on Stocktwits shows that retail sentiment has been ‘bullish’ since August on this counter.

Axis Bank shares have gained only 3% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298117_jpg_2f7ddb9196.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Ram_83262cba1d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)