Advertisement|Remove ads.

Boeing Stock Downgraded by Wells Fargo Amid Looming Labor Strike: How Investors Are Reacting

Shares of Boeing Co. (BA) are down over 3% in pre-market trading Tuesday as the aerospace giant faces a tough week with a potential labor strike and a bearish analyst downgrade weighing on the stock.

Wells Fargo analyst Matthew Akers reportedly downgraded Boeing to ‘Underweight’ from ‘Equal Weight’ and slashed the price target to $119 from $185, representing a 32% downside from its last close.

Akers believes Boeing's free cash flow could peak by 2027 as rising aircraft development costs offset future production growth.

"Boeing had a generational free cash flow opportunity this decade, driven by ramping production on mature aircraft and low investment need," Akers noted. However, he now sees cash flow from production bumping up against a new aircraft investment cycle, limiting free cash flow growth in the coming years.

Boeing’s hefty $45 billion net debt also looms large, with Wells Fargo estimating that paying it down could consume all available cash through 2030.

Compounding woes, Boeing is on the verge of a potential labor strike. The contract between Boeing and the International Association of Machinists (IAM) is set to expire on Sept. 12, and negotiations are reportedly not looking promising.

Union local head Jon Holden has expressed doubts about reaching a deal, citing disputes over wages, healthcare, retirement, and time off. The workers, who assemble Boeing’s aircraft in Washington state, are preparing for the company's first strike in 16 years.

According to Jefferies analyst Sheila Kahyaoglu, a 40% wage increase over three years would add approximately $1.5 billion in expenses annually, raising Boeing’s costs by about 2%.

The labor dispute is one of many challenges confronting new CEO Kelly Ortberg, who recently replaced Dave Calhoun and relocated to Seattle to address criticism that Boeing had lost touch with its manufacturing roots.

Ortberg’s leadership is already under intense scrutiny as Boeing grapples with high-profile issues, including fallout from fatal crashes linked to design flaws, accusations of prioritizing profits over safety, declining aircraft sales, and soaring debt levels.

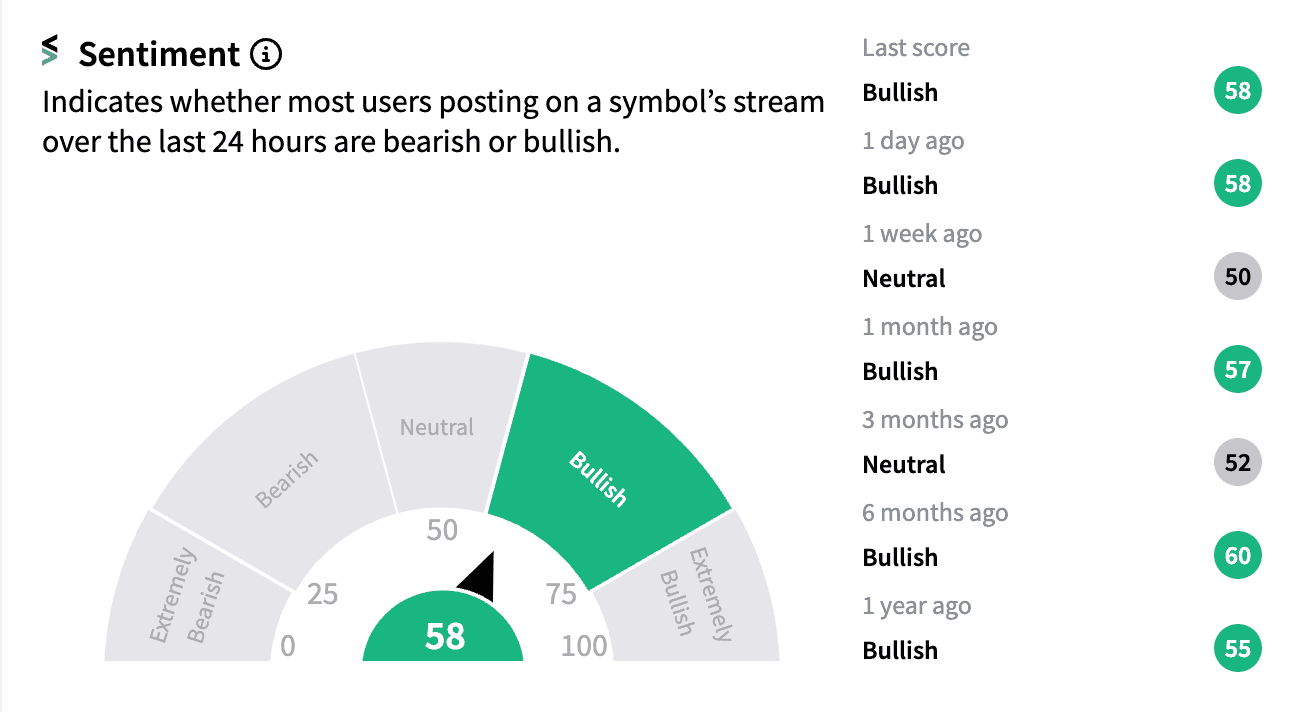

Despite the setbacks, Boeing’s stock continues to captivate retail investors. On Stocktwits, the stock was the top trending ticker before Tuesday’s opening bell, with retail sentiment leaning ‘bullish’ as traders weighed the latest news.

Boeing's stock has already plunged over 30% this year, and the looming labor strike and financial headwinds suggest that the turbulence may not be over.

Read next: GameStop Stock (GME) Heats Up On Stocktwits As Earnings Near: What’s Retail Feeling?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)