Advertisement|Remove ads.

Baidu Swings To Net Loss, Ad Slump Drags Revenue Down 7% Despite Cloud Gains

- Challenging economic conditions in China are pressuring its mainstay internet advertising business, results showed.

- Non-marketing unit, including cloud and AI, grew 21%.

- BIDU stock dropped 1% in the premarket session.

Chinese Internet search giant Baidu, Inc. posted its worst quarterly revenue drop on record on Tuesday, dragged down by sluggish advertising sales, reflecting continued caution among Chinese businesses amid challenging economic conditions.

Baidu’s revenue declined 7% to 31.2 billion yuan ($4.4 billion) for its fiscal third quarter, which ended in September, although it was better than an 8% decline penciled in by analysts. Online advertising sales declined 18% to 15.3 billion yuan.

Other parts of the business, particularly cloud computing, delivered solid growth. Non-marketing revenue — which includes the cloud division — increased 21% to 9.3 billion yuan, reflecting growing demand from enterprises for AI services.

The company reported a net loss of 11.2 billion yuan, which reflected writedowns on certain assets.

Investors React

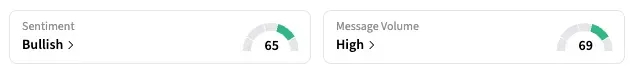

U.S.-listed shares of the company dropped 1% in premarket trading. The Hong Kong shares had closed 1.9% lower on Tuesday local time. On Stocktwits, the retail sentiment for BIDU was in the ‘bullish’ zone, with ‘high’ message volume for the ticker.

Notably, BIDU stock had declined for five sessions straight ahead of the earnings report, falling over 12% cumulatively.

Recent Developments

Baidu hosted its annual flagship event, Baidu World, in Beijing last week. It announced its next-gen AI mode, Ernie 5.0, which can jointly process text, images, audio, and video, along with two new AI chips, among other releases.

Meanwhile, noted tech investor Cathie Wood, CEO of Ark Invest, has been scooping up Baidu shares over the last several months. Several analysts have recently praised Baidu for its progress in new businesses such as AI chips and robotaxis. The company said Apollo Go, its autonomous taxi service, averaged more than 250,000 rides per week in recent months.

So far this year, BIDU has increased by 37.2%, compared to an 88.4% rise in peer Alibaba’s stock and a 31.5% rise in the sectoral fund KraneShares CSI China Internet ETF (KWEB).

($1 = 7.11 Chinese yuan)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)