Advertisement|Remove ads.

Baillie Gifford Stands Firm On Long-Term Nvidia Bet As Q3 Earnings Near: Report

- Mark Urquhart said Nvidia is focused on 2030 and even 2035 in its long-range thinking.

- Stifel has raised its price target for Nvidia to $250 from $212, reaffirming a ‘Buy’ stance.

- Nvidia is scheduled to report third-quarter earnings on November 19.

Mark Urquhart, a partner at the investment management firm Baillie Gifford, stated that NVIDIA Inc.’s (NVDA) CEO Jensen Huang and his leadership team excel in what he calls “winning in the trenches.”

Urquhart, who has covered the semiconductor sector for almost three decades, leads Baillie Gifford’s Long Term Global Growth team, which typically holds stocks for 8 to 10 years.

Long Position

According to a CNBC report, Baillie Gifford has maintained one of its most confident positions in Nvidia, even amid the recent tech downturn.

The firm has held Nvidia for nearly a decade, long before artificial intelligence captured investors’ imaginations. Urquhart emphasized that the company isn’t just focused on its next quarterly results; it is streamlining its approach toward 2030 and even 2035 in its long-range thinking.

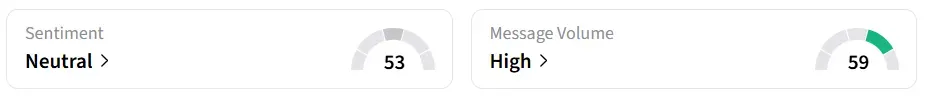

Nvidia’s stock inched over 0.8% lower in Tuesday’s premarket. On Stocktwits, retail sentiment around the stock shifted to ‘neutral’ from ‘bullish’ territory the previous day amid ‘high’ message volume levels.

Price Target Increased

Stifel has raised its price target for Nvidia to $250 from $212, reaffirming a “Buy” stance on the stock, according to TheFly. The boost comes just ahead of Nvidia’s third-quarter earnings scheduled for November 19.

The firm said that Nvidia’s CEO Jensen Huang is positioning the company as the core of next-generation AI infrastructure, backed by a cumulative order backlog exceeding $500 billion for its Blackwell and Rubin platforms in 2025 and 2026.

Analysts expect the AI bellwether to report Q3 revenue of $54.8 billion and adjusted earnings per share (EPS) of $1.25, according to Fiscal AI data.

NVDA stock has gained over 38% year-to-date and over 33% in the last 12 months.

Also See: Microsoft’s Azure, Amazon’s AWS Come Under EU’s Digital Markets Act Scanner For Potential Curbs

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)