Advertisement|Remove ads.

Bajaj Auto Holds Key Support: SEBI RA Sees Long-Term Value Despite Recent Weakness

Bajaj Auto shares have fallen 5% in the last month, but SEBI-registered analyst Deepak Pal believes that it remains a fundamentally strong, dividend-paying stock suitable for long-term accumulation, especially on dips.

Pal highlighted that the stock is holding above both its 14-day and 55-day Exponential Moving Averages (EMA) and is gradually moving towards testing its 200-day EMA.

Throughout last week, Bajaj Auto traded within a range, showing steady support around the 55-day EMA, indicating buying interest at lower levels.

Pal noted that the stock has been holding above the crucial ₹8,300 support zone while entering a correction phase. If Bajaj Auto sustains its upward momentum, it may soon test the ₹8,750-₹8,800 levels, which also coincide with its 200-day EMA.

Fundamentally, the company has a robust financial profile with a market cap of around ₹2.5-2.6 lakh crore, a P/E ratio of 32-35 times, ROE of over 24%, and virtually no debt, making it sound.

Nearly 40% of its revenue comes from exports, highlighting its global strength. Bajaj Auto also offers an attractive dividend yield of around 3.5-4%, supported by strong cash reserves, Pal added.

With increasing focus on the electric vehicle segment, particularly through its Chetak Electric brand, the company is positioned for long-term growth. However, risks include reliance on exports, domestic demand fluctuations in entry-level bikes, and rising competition from Hero MotoCorp, TVS, Royal Enfield, and EV players.

Brokerage firm Kotak Institutional Equities maintained a ‘Sell’ rating with a target of 7.250, indicating a 15% downside on Monday, citing that their EV production may face a rare earth material shortage.

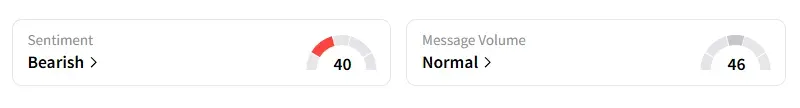

Data on Stocktwits shows retail sentiment is ‘bearish’ on this counter since a week ago.

Bajaj Auto shares fell 4% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)