Advertisement|Remove ads.

Balaji Amines Shares Gain On New Plant Approval: SEBI RA Rajneesh Sharma Sees Potential For Over 100% Returns Over 1-2 Years

Shares of Balaji Amines rose nearly 3% on Thursday after the company said it had received consent to operate its Isopropylamine (MIPA/DIPA) manufacturing facility.

Trial runs are expected to begin shortly, with commercial production to follow.

The stock has rallied nearly 20% in the last one month.

SEBI-registered analyst Rajneesh Sharma said that the recent move of Balaji Amines shares to ₹1,680 aligns with a historical trendline setup observed in prior cycles, including 2014 and 2020.

The analyst noted that the long-term logarithmic trendline continues to act as a strong support, with volume patterns suggesting the breakout is still in its early phase.

Sharma pointed to Balaji Amines’ balance sheet improvements over the past five years, citing a drop in borrowings from ₹260 crore to ₹11 crore.

He also noted a rise in reserves from ₹652 crore to ₹1,839 crore, enabled by over ₹1,100 crore in capex, largely funded through internal accruals.

Key business drivers being tracked include the ramp-up of DME, DMC, and NBPT capacities, as well as backward integration through BSCL to reduce raw material costs.

The analyst added that while methanol prices pose a near-term risk to margins, the broader structural thesis remains intact.

A target range of ₹2,800–₹3,900 over 12–24 months has been maintained, contingent on volume confirmation and a continuation of the current technical setup.

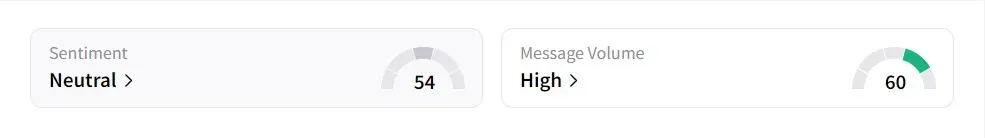

On Stocktwits, retail sentiment was ‘bullish’ amid ‘high’ message volume.

The stock has declined 4.6% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)