Advertisement|Remove ads.

Bandhan Bank sees margin recovery from third quarter, targets 11-12% credit growth, says MD Sengupta

Partha Pratim Sengupta, MD and CEO of Bandhan Bank, expressed confidence that the bank’s performance has bottomed out and is now poised for an upward trajectory after a challenging quarter.

Bandhan Bank’s management remains confident that its net interest margin (NIM) has bottomed out in the July-September quarter of FY26 (Q2FY26) and is set to improve in the coming quarters.

Partha Pratim Sengupta, Managing Director and Chief Executive Officer, acknowledged that the recent quarter was challenging and the sharper-than-expected margin compression to 5.8% stemmed from several factors, which he also outlined while expressing optimism about recovery.

Sengupta cited four main reasons for the margin pressure. First, the bank passed on repo rate hikes to borrowers at the start of the quarter. Second, as part of a long-term strategic move, Bandhan recalibrated its Marginal Cost of Funds-based Lending Rate (MCLR), reducing it by 200 basis points to align more closely with peers. Third, while the bank moderated its savings deposit rates, the benefit from repricing high-cost fixed deposits taken earlier is yet to be reflected—a positive impact expected to begin in the October-December quarter of 2025 (Q3FY26) and strengthen in the January-March quarter of 2026 (Q4FY26). Finally, higher-than-anticipated slippages from the microfinance (emerging entrepreneurs' business, or EEB) segment weighed on profitability.

Despite these headwinds—which led to what Sengupta described as one of the lowest profit quarters in the bank’s history—he expressed confidence in a turnaround, saying the performance has likely bottomed out and will improve from here.

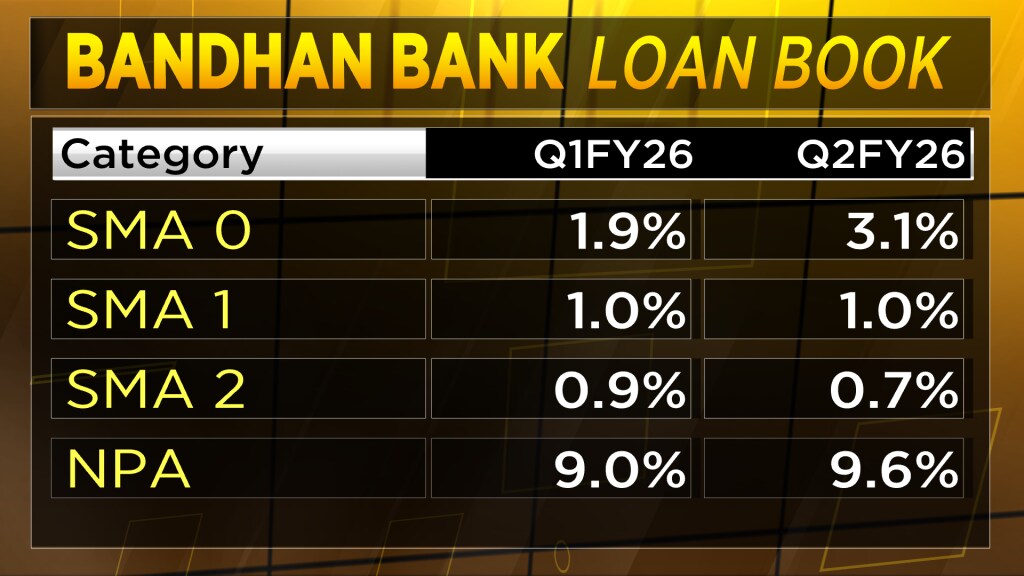

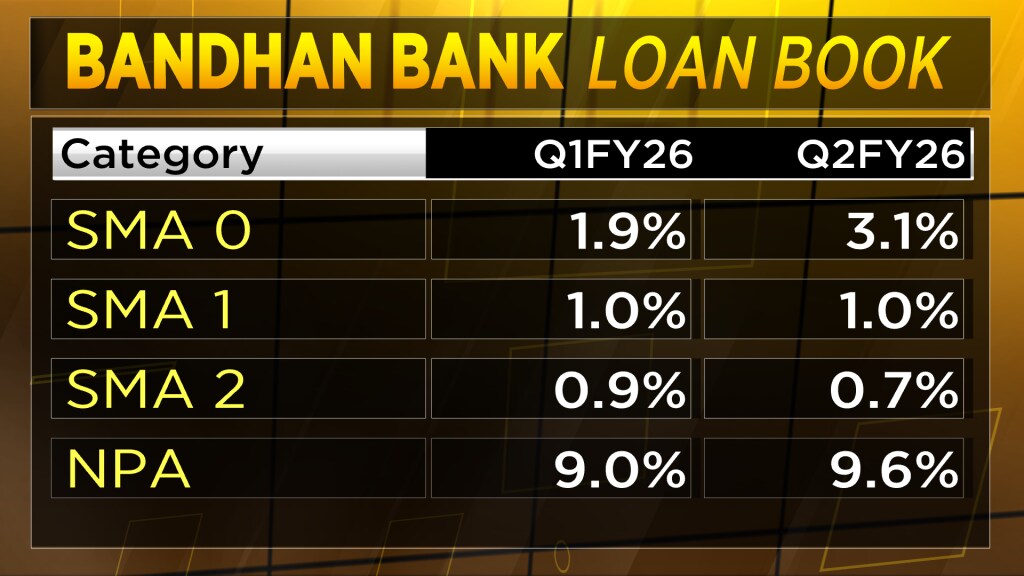

On the business front, Sengupta is targeting overall credit growth of 11–12% for 2025-26 (FY26). He noted a clear divergence in the loan book: the non-EEB portfolio (retail, housing, and wholesale loans) grew 24% year-on-year, while the EEB or microfinance book contracted 13%, reflecting the bank’s strategy to diversify and evolve into a universal bank.

Also Read: Banks lead renewed investor interest in Indian financials

He also reiterated that deposit growth will continue to outpace credit growth, supporting a stable funding base. With these measures and better treasury performance expected in the second half, the bank anticipates a stronger finish to the year.

For Q2FY26, Bandhan Bank reported an 88% year-on-year drop in net profit to ₹112 crore, missing estimates, as net interest income declined 11.8% to ₹2,588.6 crore. Gross advances rose 7.2% to ₹1.40 lakh crore, while deposits increased 10.9% to ₹1.58 lakh crore.

Also Read: Bandhan Bank shares decline 6% as CLSA downgrades stock, cuts price target on weak Q2

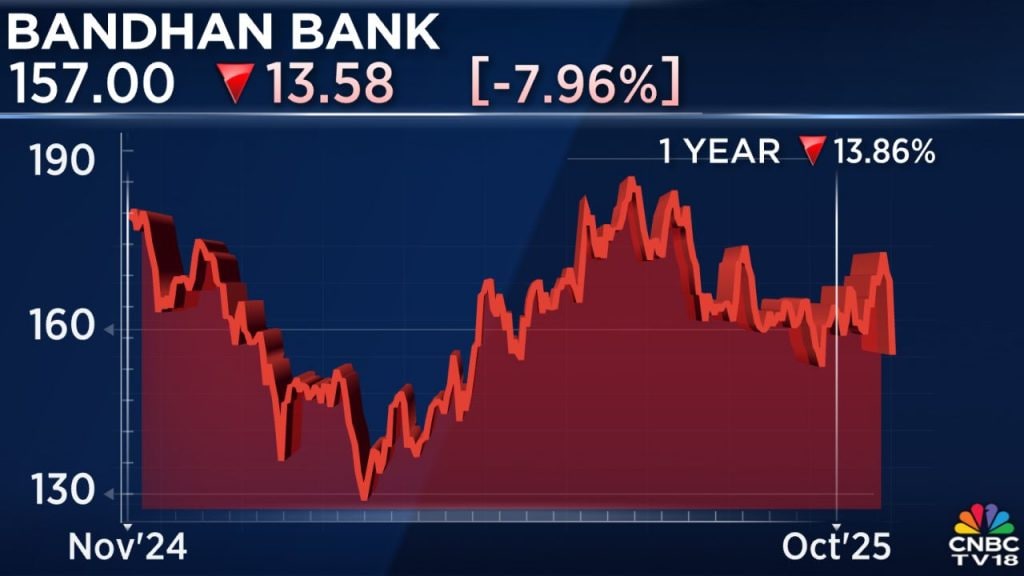

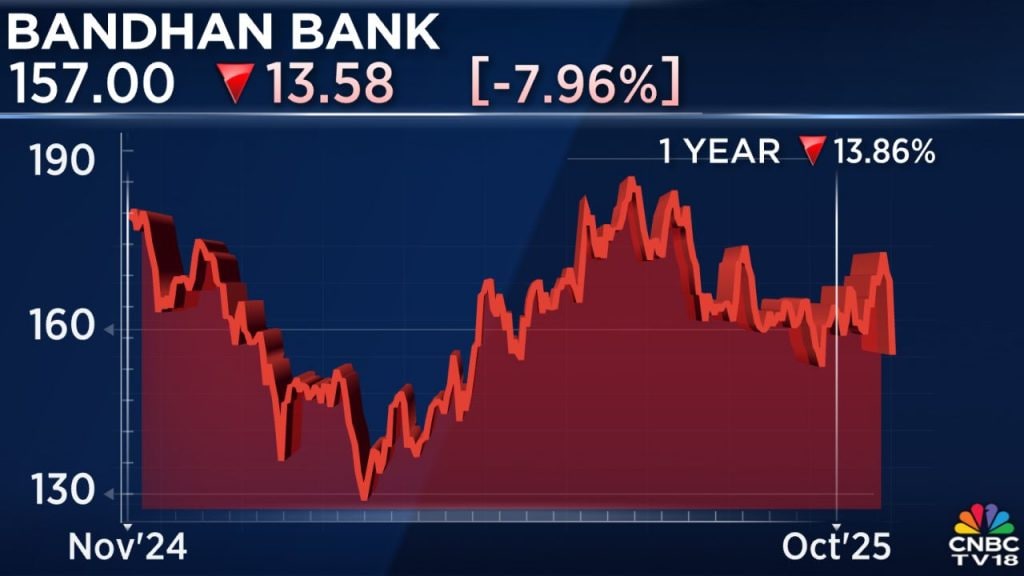

Kolkata-based Bandhan Bank currently has a market capitalisation of around ₹25,292 crore, with shares down nearly 14% over the past year.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Partha Pratim Sengupta, Managing Director and Chief Executive Officer, acknowledged that the recent quarter was challenging and the sharper-than-expected margin compression to 5.8% stemmed from several factors, which he also outlined while expressing optimism about recovery.

Sengupta cited four main reasons for the margin pressure. First, the bank passed on repo rate hikes to borrowers at the start of the quarter. Second, as part of a long-term strategic move, Bandhan recalibrated its Marginal Cost of Funds-based Lending Rate (MCLR), reducing it by 200 basis points to align more closely with peers. Third, while the bank moderated its savings deposit rates, the benefit from repricing high-cost fixed deposits taken earlier is yet to be reflected—a positive impact expected to begin in the October-December quarter of 2025 (Q3FY26) and strengthen in the January-March quarter of 2026 (Q4FY26). Finally, higher-than-anticipated slippages from the microfinance (emerging entrepreneurs' business, or EEB) segment weighed on profitability.

Despite these headwinds—which led to what Sengupta described as one of the lowest profit quarters in the bank’s history—he expressed confidence in a turnaround, saying the performance has likely bottomed out and will improve from here.

On the business front, Sengupta is targeting overall credit growth of 11–12% for 2025-26 (FY26). He noted a clear divergence in the loan book: the non-EEB portfolio (retail, housing, and wholesale loans) grew 24% year-on-year, while the EEB or microfinance book contracted 13%, reflecting the bank’s strategy to diversify and evolve into a universal bank.

Also Read: Banks lead renewed investor interest in Indian financials

He also reiterated that deposit growth will continue to outpace credit growth, supporting a stable funding base. With these measures and better treasury performance expected in the second half, the bank anticipates a stronger finish to the year.

For Q2FY26, Bandhan Bank reported an 88% year-on-year drop in net profit to ₹112 crore, missing estimates, as net interest income declined 11.8% to ₹2,588.6 crore. Gross advances rose 7.2% to ₹1.40 lakh crore, while deposits increased 10.9% to ₹1.58 lakh crore.

Also Read: Bandhan Bank shares decline 6% as CLSA downgrades stock, cuts price target on weak Q2

Kolkata-based Bandhan Bank currently has a market capitalisation of around ₹25,292 crore, with shares down nearly 14% over the past year.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://images.cnbctv18.com/uploads/2022/08/renewable-energy.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/06/standard-chartered.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Roku_logo_jpg_1323183cec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/04/hindustan-unilever-limited-hul-2025-04-7b7016059443ebc53baa779206296c8c.jpg)