Advertisement|Remove ads.

Bank of America CEO Can’t Figure Out Warren Buffett’s Motive As Berkshire’s Stake Sale Tops $7B: Retail Turns Bearish

Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) continued reducing its stake in Bank of America (BAC), selling over 5.79 million shares of the lender between Friday and Tuesday. Shares of the bank fell nearly 2% on Wednesday following the disclosure.

The sale, which was conducted at prices ranging from $39.2978 and $39.6682, raked in over $228 million taking the overall sale value to nearly $7.2 billion. Following the transaction, Berkshire still holds over 858 million shares of the bank, according to an SEC filing. The bank reportedly stands at the third position in Berkshire’s top holdings after Apple Inc (AAPL) and American Express Company (AXP).

Buffett had bought Bank of America’s preferred stock and warrants in 2011 and had converted the warrants in 2017, following which Berkshire became the largest shareholder of the lender.

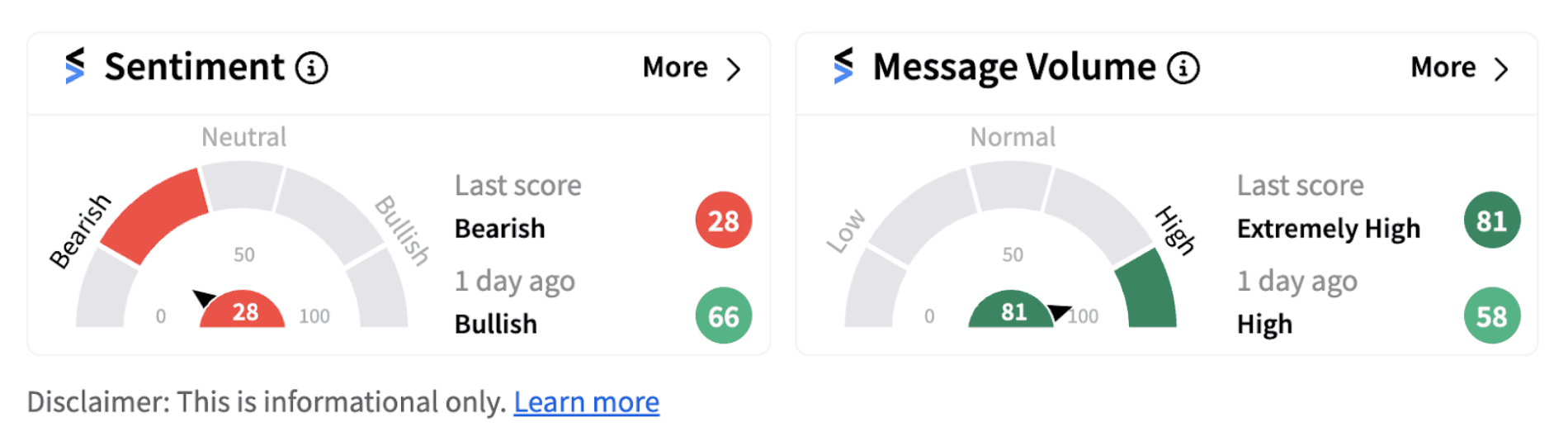

Following the latest disclosure, retail sentiment on Stocktwits dipped into the ‘bearish’ territory (28/100) from ‘bullish’ a day ago.

BofA CEO Brian Moynihan reportedly said he has no knowledge of Buffett’s motive for selling. “I don’t know what exactly he’s doing, because frankly, we can’t ask him. We wouldn’t ask,” he said during the Barclays Global Financial Services Conference, according to CNBC. “But on the other hand, the market’s absorbing the stock .... we’re buying a portion of the stock, and so life will go on.”

Indeed, BofA stock has remained resilient to the huge volumes hitting the market since mid-July. The stock is up over 13% on a year-to-date basis as investors remained optimistic on the bank’s prospects following its upbeat second quarter earnings.

BofA reported revenues of $25.4 billion, topping an estimate of $25.22 billion. Earnings per share came in at $0.83 versus an estimated $0.80. The bank’s net interest income (NII), the difference between interest earned and interest expended, fell 3% to $13.7 billion as higher deposit costs more than offset higher asset yields and modest loan growth.

A few Stocktwits users are expressing skepticism about the stock’s prospects in the coming times. One user named ‘Chartist0_0’ believes it is unlikely to record any significant returns in the coming years.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)