Advertisement|Remove ads.

Dell Expects Continued Headcount Reduction As It Focuses On Cost-Cutting Measures: Retail Appears Unmoved

Dell Technologies Inc (DELL) said in an exchange filing that it expects a continued reduction in its overall headcount as the firm focuses on cost reduction measures.

“Throughout Fiscal 2025, we remain committed to disciplined cost management in coordination with our ongoing business transformation initiatives and will continue to take certain measures to reduce costs, including limitation of external hiring, employee reorganizations, and other actions to align our investments with our strategic priorities and customer needs,” the firm said.

Dell also stated that it expects the demand environment will continue to improve throughout the remainder of fiscal 2025 as the macroeconomic environment continues to stabilize.

Although the pricing environment is expected to remain competitive throughout the fiscal, the tech-major believes net revenue growth for the full fiscal year will be primarily driven by ISG net revenue attributable to its AI-optimized servers and continued demand improvement for its traditional servers.

Interestingly, CFO Yvonne McGill had stated during Dell’s Q2 results that the firm’s momentum in ISG is a significant tailwind. "In Q2 our combined ISG and CSG revenue was $24.1 billion, up 12% year over year, positioning us well for the second half of the year and beyond,” McGill had stated.

Indeed, Q2 demand for the firm’s AI servers remained strong, with orders revenue up 23% quarter-over-quarter to $3.2 billion. The company said it exited Q2 with a backlog at $3.8 billion.

Notably, the tech major had earlier trimmed its full-year revenue outlook to the range of $95.5 and $98.5 billion versus a prior guidance of $93.5 and $97.5 billion.

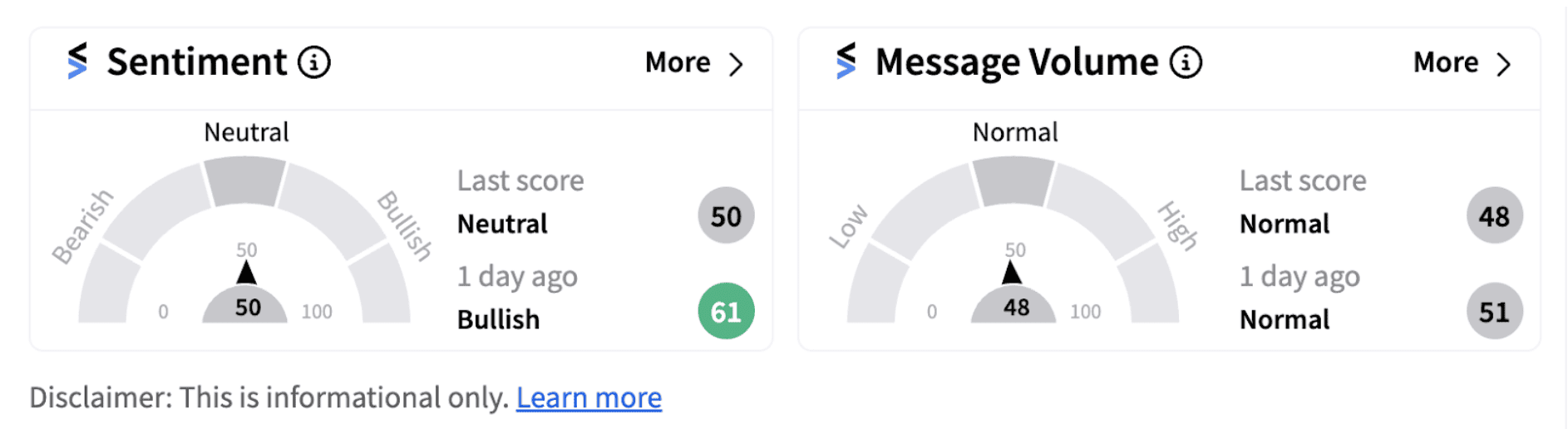

Retail sentiment on Stocktwits inched-down into the ‘neutral’ territory (50/100) on Wednesday from ‘bullish’ a day ago.

Dell also anticipates input costs to rise during the second half of fiscal 2025, primarily led by expected inflation for component costs.

Shares of the tech giant have gained over 42% since the beginning of the year with almost 12% gains recorded over the last month itself as the stock gets ready to be added to the S&P 500 index later this month.

Bullish followers of Dell are optimistic on the stock given its attractive valuation.

Also See: Amazon Stock In Focus After Cloud Division AWS Commits $10B Investment In UK: Retail Investors Cheer

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)