Advertisement|Remove ads.

Banks lead renewed investor interest in Indian financials

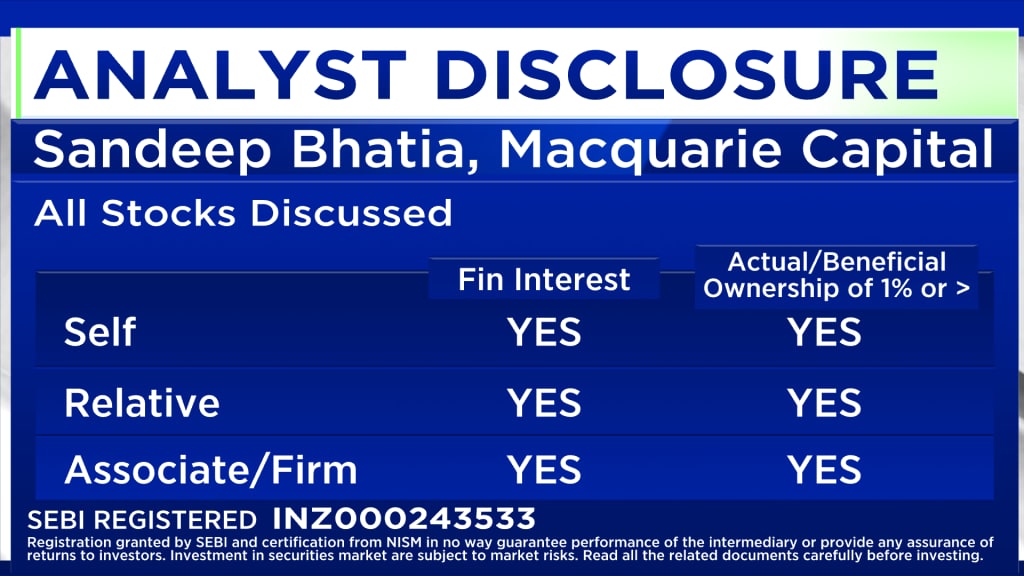

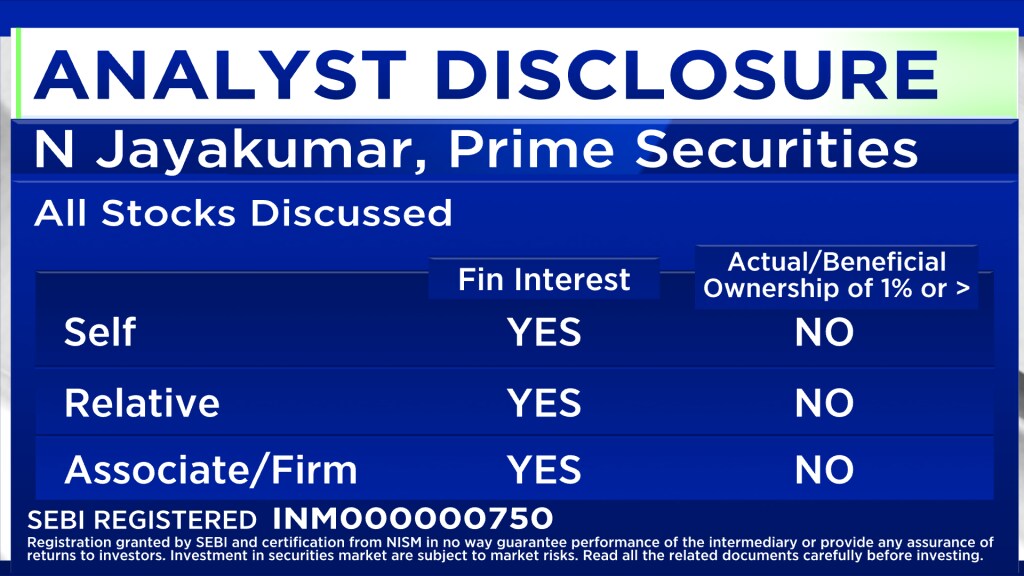

N Jayakumar, Group CEO & MD at Prime Securities and Sandeep Bhatia, MD & Head-Equity India at Macquarie Capital shared why India’s financial sector is set for a comeback — driven by renewed FDI interest, strong consumer spending, and improving bank balance sheets after the RBL–Emirates NBD deal.

The Indian financial sector is once again in the spotlight as improving consumer sentiment, steady credit growth, and large strategic deals reignite investor interest.

Sandeep Bhatia, Managing Director and Head of Equity India at Macquarie Capital, stated that the sector’s attractive valuations have long drawn both domestic and foreign investors, and the environment now looks primed for a sustained recovery. “The finance sector has always been cheap,” he said, adding that stronger consumer spending and lending momentum are aligning for a comeback in bank earnings and stock performance.

N Jayakumar, Group CEO and Managing Director at Prime Securities, believes this revival is reflected in the recent RBL Bank–Emirates NBD deal, which he called a clear signal of renewed foreign direct investment (FDI) interest in Indian banking. He explained that when fresh foreign capital enters India, “the first sector it comes through is the BFSI space.” The transaction, he said, highlights global confidence in India’s well-managed mid-sized banks that have cleaned up their books and are ready for growth.

RBL Bank is transforming from a mid-sized lender into a stronger player with ₹43,000 crore in capital, he said. “They’ve guided for an ROA of 1% by the end of the year,” he added, noting that the bank can now “rub shoulders with, if not the top four, then the next of kin” among private banks. With legacy issues addressed and the loan portfolio strengthened, he said the next phase will focus on how RBL uses its capital to expand its balance sheet over the next three to four years.

Also Read: ANZ’s Yetsenga says 2026 to be stronger year for India as cyclical recovery builds

Jayakumar also emphasised the strategic importance of the deal, calling it a milestone in the deepening financial and economic partnership between India and the UAE. “There is capital waiting to come in, especially in the space we talked about,” he said, pointing to the attractiveness of India’s financial sector for global investors.

While sharing the optimism, Bhatia cautioned that selectivity remains key. “It speaks about the opportunity in the sector, rather than the quality of the specific bank,” he said, stressing that India’s top private and public sector lenders continue to enjoy stronger management and governance standards.

Also Read: Gold’s rally backed by fundamentals, not froth: World Gold Council’s Sachin Jain

Looking ahead, Bhatia expects a steady but moderate year for equities. “It’s a 10–12% return market, not a 20–25% one,” he remarked, urging investors to stay realistic amid rising liquidity and fund inflows.

Beyond financials, Jayakumar also sees promise in metals and currency. With China cutting metal production and the dollar showing signs of weakness, he expects metals to benefit. He added that the rupee “may have peaked out in the short run around 88.5–89,” presenting a potential entry opportunity for investors betting on stability.

For the entire discussion, watch the accompanying video

Catch all the latest updates from the stock market here

Sandeep Bhatia, Managing Director and Head of Equity India at Macquarie Capital, stated that the sector’s attractive valuations have long drawn both domestic and foreign investors, and the environment now looks primed for a sustained recovery. “The finance sector has always been cheap,” he said, adding that stronger consumer spending and lending momentum are aligning for a comeback in bank earnings and stock performance.

N Jayakumar, Group CEO and Managing Director at Prime Securities, believes this revival is reflected in the recent RBL Bank–Emirates NBD deal, which he called a clear signal of renewed foreign direct investment (FDI) interest in Indian banking. He explained that when fresh foreign capital enters India, “the first sector it comes through is the BFSI space.” The transaction, he said, highlights global confidence in India’s well-managed mid-sized banks that have cleaned up their books and are ready for growth.

RBL Bank is transforming from a mid-sized lender into a stronger player with ₹43,000 crore in capital, he said. “They’ve guided for an ROA of 1% by the end of the year,” he added, noting that the bank can now “rub shoulders with, if not the top four, then the next of kin” among private banks. With legacy issues addressed and the loan portfolio strengthened, he said the next phase will focus on how RBL uses its capital to expand its balance sheet over the next three to four years.

Also Read: ANZ’s Yetsenga says 2026 to be stronger year for India as cyclical recovery builds

Jayakumar also emphasised the strategic importance of the deal, calling it a milestone in the deepening financial and economic partnership between India and the UAE. “There is capital waiting to come in, especially in the space we talked about,” he said, pointing to the attractiveness of India’s financial sector for global investors.

While sharing the optimism, Bhatia cautioned that selectivity remains key. “It speaks about the opportunity in the sector, rather than the quality of the specific bank,” he said, stressing that India’s top private and public sector lenders continue to enjoy stronger management and governance standards.

Also Read: Gold’s rally backed by fundamentals, not froth: World Gold Council’s Sachin Jain

Looking ahead, Bhatia expects a steady but moderate year for equities. “It’s a 10–12% return market, not a 20–25% one,” he remarked, urging investors to stay realistic amid rising liquidity and fund inflows.

Beyond financials, Jayakumar also sees promise in metals and currency. With China cutting metal production and the dollar showing signs of weakness, he expects metals to benefit. He added that the rupee “may have peaked out in the short run around 88.5–89,” presenting a potential entry opportunity for investors betting on stability.

For the entire discussion, watch the accompanying video

Catch all the latest updates from the stock market here

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_UAL_New_47917d2c93.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_national_cancer_institute_Cx0_Ls_Yr_M_Ns_unsplash_b3dc9b6ace.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cleveland_cliffs_OG_jpg_53ba327db1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_jpg_6c4cc95d17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2226816968_jpg_f7de55409b.webp)