Advertisement|Remove ads.

Barclays Downgrades Target To ‘Sell’, Says Big Box Retailer Needs A Strategic Overhaul

Barclays downgraded its rating on Target Corp's (TGT) shares to 'Underweight' from 'Equal Weight' on Monday, sending the stock down 1.7%.

The research firm stated that the big-box retailer could struggle to grow sales amid intense competitive pressure without a significant overhaul. In May, Target reported first-quarter results that missed expectations and cut its full-year sales outlook, blaming weak discretionary spending by consumers and headwinds from U.S. tariffs.

"Absent a bigger strategic shift, we believe sales will continue to underperform... the macro seems like it could get worse as inflation is just starting to accelerate," the research firm said.

Barclays stated that, while the comparisons are more favourable for Q2, Target is lagging behind its peers in both consumables and general merchandise. Sales trends are the weakest among the company's more frequent shoppers, it said.

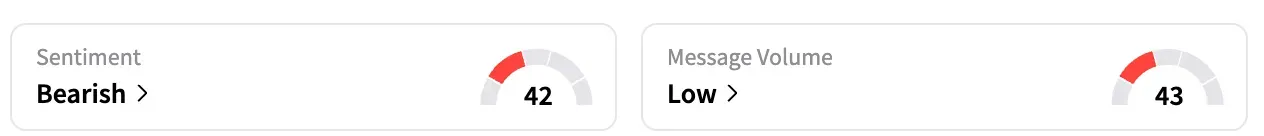

On Stocktwits, sentiment for Target’s stock remained in the 'bearish' zone, unchanged for several months. TGT shares are down 24.8% year-to-date.

A retail watcher speculated that Target’s stock was set to fall further based on technical signals.

Barclays expects the company to discuss growth initiatives in the upcoming earnings, but this is not enough to justify investment in the stock at this point. The firm maintained its price target at $91, indicating a nearly 12% upside to Target's last closing price.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)