Advertisement|Remove ads.

Bernstein Cuts Starbucks Price Target While Maintaining Bullish View: Retail Investors Await Turnaround Effort To Show Results

Marquee brokerage Bernstein on Friday cut its price target on coffee chain Starbucks Corp's (SBUX) shares while maintaining an 'Outperform' rating following the stock's recent drop.

The research firm cut the target to $105 from $115, according to Investing.com, signaling a 28% upside to the current levels.

Analysts at Bernstein said the business faces the dual pressure of implementing a turnaround amid challenging market conditions.

They believe an inflation-induced recession may not hit Starbucks as hard as the 2008 financial crisis. Since it's likely to impact lower-income consumers more, it will leave Starbucks' core customer base relatively less affected and help sustain demand.

Moreover, the chain has multiple "low-hanging fruits" that provide clear opportunities and internal controls to navigate the business, according to Bernstein.

Starbucks has made several changes in recent years. Early last year, it cut its workforce by 15% and hired Brian Niccol as CEO in September.

Niccol is credited with reviving the burrito chain Chipotle Mexican Grill (CMG) in his last CEO role.

Under Niccol, Starbucks is revamping its menu and cafes and cutting order times, among other initiatives.

The company suspended its forecasts for 2025 late last year to give Niccol freedom to pursue its restructuring.

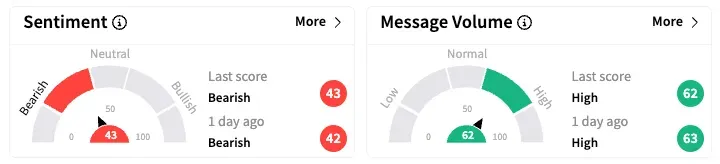

On Stocktwits, retail sentiment held in the 'bearish' territory with 'high' message volume.

Several users said the rising coffee bean prices will make Starbucks lattes expensive, pushing consumers away, although some noted that any change to tariff rates in Asia could instantly reverse the stock's trajectory.

Shares of SBUX are down 10% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252194207_jpg_9605cd50d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)