Advertisement|Remove ads.

Beyond Meat Stock Set Another Big Drop, But Retail Traders Keep Faith In This Meme Name

- Last week, Mizuho reduced the stock's price target to $1.50 from $2 and maintained a ‘Sell’ rating.

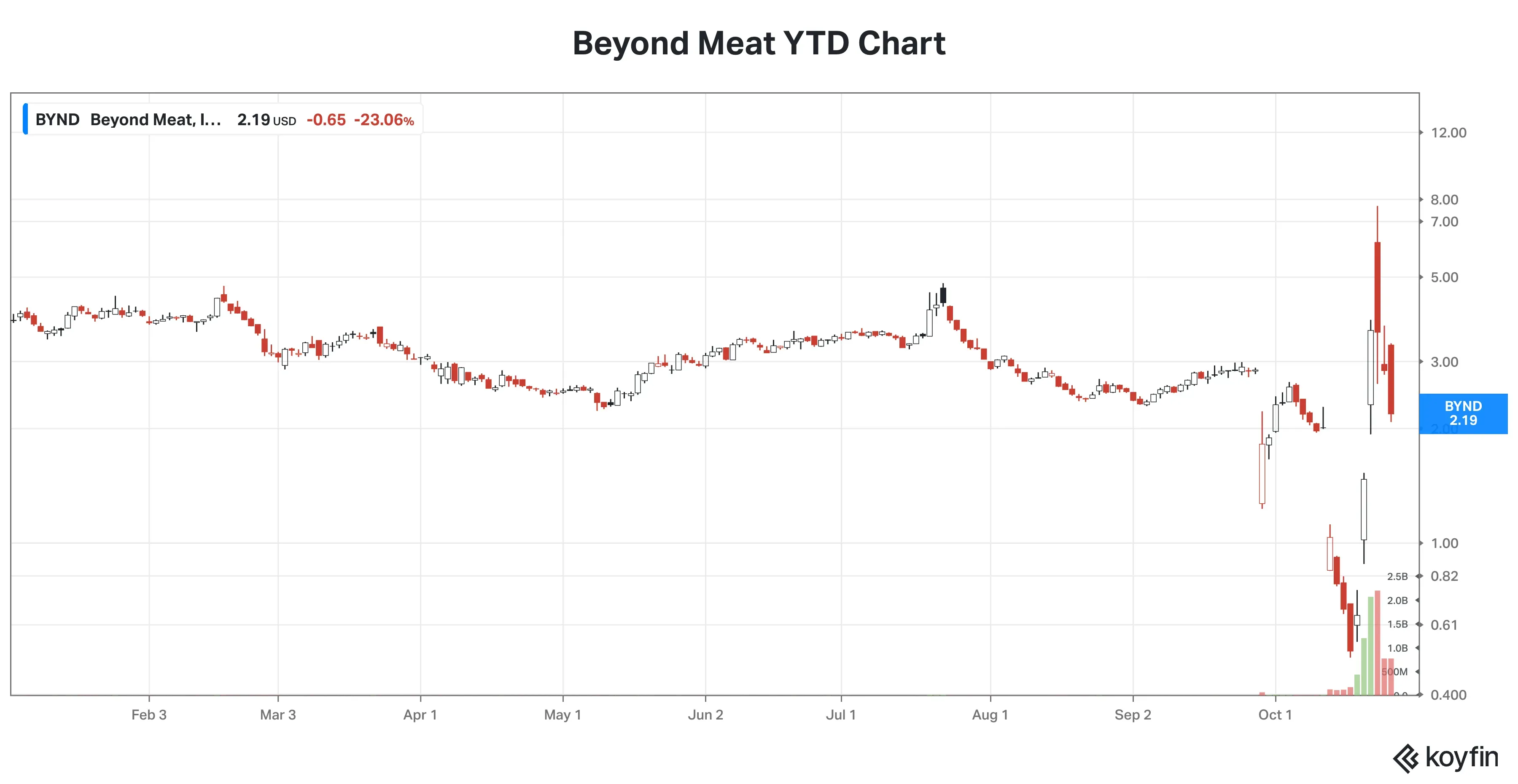

- For the year, Beyond Meta stock has slumped 42%, contrasting with the record levels of the broader S&P 500 Index.

- Stocktwits users have been optimistic about the stock despite its volatility.

Beyond Meat, Inc. (BYND) stock has been on a volatile ride since early October, earning meme status, and it appears on track to open sharply lower in Monday’s session.

In overnight trading, Beyond Meat stock is down nearly 15%, according to Yahoo Finance.

Beyond Meat’s Rally & Retreat

Shares of Beyond Meat, a maker of plant-based meat, plunged 23% on Friday, defying the broader market rally. The downside trigger was a commentary from Mizuho analyst Baumgartner that the stock would suffer from significant equity dilution following the conversion of the senior notes due 2027, according to the Fly. The analyst reduced the stock's price target to $1.50 from $2 and maintained a ‘Sell’ rating, citing the company’s weak market position and fundamentals, the Fly reported.

The company announced on Thursday that the lock-up restrictions on certain of the 316.15 million shares issued on Oct. 15 in connection with the note offering would expire at 5 p.m. ET that day.

Separately, in an 8-K filing, Beyond Meat disclosed preliminary results for the September quarter, expecting revenue of about $70 million compared to the guidance of $68 million to $73 million and the Fiscal.ai-compiled consensus of $69.79 million. The company expects a gross margin of 10%-11%, including $1.7 million in expenses related to suspending China operations. The company also flagged a non-cash impairment charge related to certain of its long-lived assets that haven’t been included in the preliminary numbers.

On Thursday, Beyond Meat’s stock plunged about 21% as traders took profit after a strong two-day rally. The recent downtrend followed a substantial two-day advance. Beyond Meat stock jumped about 128% on Monday and then surged another 146% on Tuesday. Much of the buoyancy in the El Segundo, California-based company’s stock was due to the distribution agreement it clinched with Walmart. It also announced the debut of its latest iterations of its Beyond Burger and Beyond Beef at Erewhon locations.

Chart courtesy of Koyin

Chart courtesy of Koyin

What Retail’s Saying About Beyond Meat Stock

Stocktwits users have been optimistic about the stock despite its volatility. Retail sentiment toward Beyond Meat stock has largely been ‘extremely bullish’ for about three months now. The message volume on the stream has also been at ‘extremely high’ levels.

A bullish user said that short covering creates inevitable demand. “Our strategy stays crystal clear: buy, hold, and rocket the squeeze to Mars!” they said. According to Koyfin, the stock's short interest is a whopping 51.60%.

Another user sounded positive about the company’s products being at big retail stores, including Walmart, Costco, Target, Safeway, Aldi, Whole Foods, and Sprouts.

For the year, Beyond Meta stock has slumped 42%, contrasting with the record levels of the broader S&P 500 Index. During the same period, the iShares US Consumer Staples ETF (IYK) has gained 7.25%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)