Advertisement|Remove ads.

Beyond Meat Stock Set For Another Sizzling Rally: Expanded Walmart Deal, Meme ETF Inclusion Makes Retail Hungrier

- Beyond Meat’s shares might extend their winning streak following gains over the past two sessions.

- The faux meat seller announced an expanded partnership with Walmart on Tuesday.

- Retail investors are extremely bullish on the stock, despite shares having underperformed for years.

Beyond Meat, Inc.’s stock soared nearly 43% in early premarket trading on Wednesday, extending its strong rally following news of an expanded partnership with Walmart, Inc., keeping retail investors tuned in.

On Tuesday, Beyond Meat announced that its select products, including the new Beyond Burger 6-Pack, would soon be available in more than 2,000 Walmart stores nationwide. The company positioned the news as a major step in delivering affordable, protein-packed food to more households at a time when consumers are turning to healthier alternatives.

Shares of Beyond Meat gained 146% on Tuesday, following the news, as well as the stock’s addition to the Roundhill Meme Stock ETF (MEME) announced the same day. The inclusion increases the stock’s visibility with investors and would likely attract additional trading demand from retail-focused funds. Interestingly, shares had gained 127% on Monday without a clear trigger.

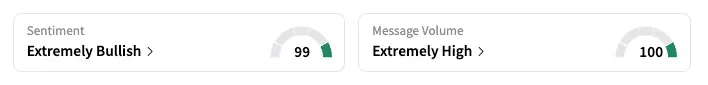

As of early Wednesday, the retail trader sentiment for BYND had shifted to ‘extremely bullish’ (99/100), climbing a few notches higher since the start of the week. The 24-hour message volume for the ticker rose 180%.

Now confirmed as a meme stock, Beyond Meat could see further gains, users forecast. “Tomorrow is day 3. Historically with a squeeze, that’s always the highest volume and biggest day for movement,” said one user.

“On day 3 GME went up 350%. I believe a similar price action can happen here which would catapult us past $10! Let’s get it tomorrow y’all,” added this user.

Another user forecast $20 price by Friday.

The rally is a shot in the arm for the battered BYND stock, which has declined over 80% this year until Monday, due to shrinking demand for the company’s alternative meat products.

After a strong 2022 IPO that saw shares peak at $222, the stock has traded below $10 since late 2023, with the company’s annual sales declining over the past three years. The stock suffered a sell-off only last week after debt conversion and changes to its board.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_inflation_resized_f8af31ca5a.jpg)