Advertisement|Remove ads.

Beyond Meat’s Short Interest At Over 4-Year Low, Stock Rebound Boosts Retail Buzz

- Short interest in Beyond Meat stock dropped to 13.2%, the lowest since February 2021.

- After falling for three sessions after poor quarterly results last Monday, the stock rebounded on Friday, gaining 7%

- Several retail investors on Stocktwits expect BYND to gain this year, including from a potential short squeeze.

After last Monday’s disappointing results, Beyond Meat shares slid for three straight sessions, wiping out a quarter of their value. However, a few key signals indicate a rebound is building, with retail investors taking notice.

Shares of the faux-meat company rose 7% on Friday and added another 1% in after-hours trading, while short interest fell to 13.2% last week — its lowest level since February 2021, according to Koyfin.

Could This Be A Major Week?

“Is this the week for BYND?” a Stocktwits user remarked, with several others posting plans to buy shares as markets open on Monday with a potential target of $7 or $10 by the end of the week. “$BYND wake me up when we push through $2.15,” another said.

Users also speculated on a potential short squeeze this week. Notably, the heaviest activity was clustered in very short-dated calls (Nov. 21), especially for the $1.50 and $2.00 call options, according to data from Investing.com.

“Price went up and volume increased (on Friday) — but the short interest didn’t drop. That means they couldn’t find shares to deliver,” said a user, as part of an analysis for near-term trade.

“Monday is their only window. They must cover (between) 9AM–4PM Monday. If they don’t? Tuesday = Forced Buy-Ins. And forced buy-ins always happen at whatever price the stock is trading at.”

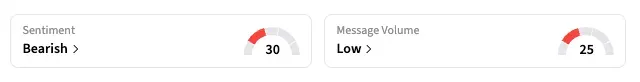

That said, the Stocktwits sentiment for BYND remained in the ‘bearish’ zone as of late Sunday, unchanged over the past week. The stock has declined 23.4% over the week and 72% year-to-date.

Beyond Meat’s Fundamentals And Plans

From a fundamental point of view, Beyond Meat looks weak. It reported a sharp drop in sales and profit in the last quarter, and the current quarter’s revenue outlook also fell short of Wall Street’s expectations. An $81.2 million impairment charge made the company’s balance sheet look worse.

CEO Ethan Brown admitted the company has “been in our turnaround phase for too long,” promising investors more action than talk as the faux-meat maker pushes for a revival. He said that recent debt reduction and plans to strengthen marketing and improve in-store placement leave the company in a better position.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Trump’s Food Tariff Cut Likely To Trim Import Costs For Hershey, Dr. Pepper, Vita Coco, Analyst Says

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)