Advertisement|Remove ads.

Bharat Dynamics’ Valuation Overstretched; SEBI RA Warns Of Correction Risks

State-owned defense equipment maker Bharat Dynamics (BDL) has seen a ten-fold increase in its stock’s value since 2018, driven by tailwinds in the sector and the ‘Make In India’ initiative.

However, its current price action is hitting a critical technical juncture, according to SEBI-registered analysts SharesNservices. On the technical charts, the stock is facing strong resistance between ₹2,000 and ₹2,100, with a key trendline support near ₹1,580.

A breakdown below this level could lead to downside towards the ₹1,450 zone. If that is breached, the stock could fall further to ₹1,300, or even as low as ₹1,100, which is likely to result in investors panicking, the analysts added. The chart also shows signs of exhaustion after a steep rally, and indicators suggest overbought conditions.

BDL stock is currently trading 0.5% higher at ₹1,729.30 on Tuesday.

Despite the remarkable price surge, from an adjusted post-split price of ₹200 to ₹2,015 it touched in June, the fundamentals haven’t kept pace, the analysts noted.

Revenue has declined from ₹4,588 crore in FY18 to ₹3,345 crore in FY25, while net profit has remained nearly flat at ₹550 crore. Meanwhile, the P/E ratio has ballooned from ~11× in FY18 to over 111× in FY25.

This steep rerating has been driven by defence sector tailwinds, PSU re-rating trends, and export optimism around missile systems like Akash and QRSAM, they said.

However, execution risks remain high. Any order delay or earnings miss could result in a sharp correction given the high expectations already baked in.

Overall, BDL’s long-term prospects remain strong, but near-term risk is elevated. The stock appears technically stretched and is fundamentally overvalued. The analysts recommended that investors wait for valuation comfort rather than taking up new positions on hype.

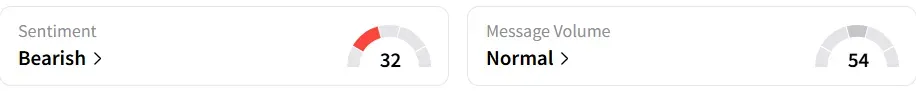

Retail sentiment on Stocktwits remains ‘bearish’.

Year-to-date, the stock has gained over half its value.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)