Advertisement|Remove ads.

Bharat Forge Shows Recovery Signs After Weekly Drop: SEBI RA Pegs ₹1,200 As Crucial Support

Bharat Forge appears to be staging a recovery in Tuesday’s trade after a sharp decline of over 5% in the past week.

The stock broke below its 200-day moving average on July 14, signaling weakness and raising concerns about further downside, SEBI-registered analyst Anupam Bajpai said.

After the breakdown, candlesticks on July 11 and 14 closed entirely outside the lower Bollinger Band, signaling that the stock had entered an oversold zone, Bajpai added. This pattern typically indicates that selling pressure may be exhausted, and the emergence of a short-term rebound.

Bharat Forge shares were up 2.2% to ₹1,236.10 in late afternoon trade, signaling a potential technical pullback.

If the recovery continues, the stock could attempt to retest its 200-day moving average at ₹1,251, which now acts as the immediate resistance, the analyst said.

On the downside, ₹1,200 is emerging as a key support level. Sustaining above this threshold increases the likelihood of a continued recovery, Bajpai stated. However, if the stock breaks below ₹1,200 again, it could trigger fresh selling and extend the downtrend.

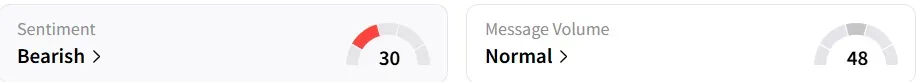

Retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a week ago.

Year-to-date, the stock has shed 5.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_amazon_walmart_jpg_05c61e928f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2167490837_jpg_471b0d5535.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231498932_jpg_bdd44fc548.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AEHR_chip_maker_3698bf2343.jpg)