Advertisement|Remove ads.

BHEL Gains On Adani Power Order: SEBI RA Says Wait For Confirmed Breakout Above ₹272

Bharat Heavy Electricals (BHEL) shares hit an eight-month high, rising over 3% intraday on Monday after securing a ₹6,500-crore order from Adani Power. The stock hit ₹272.10 — its highest level since October 17, 2024, in early trade.

The engineering giant will supply critical equipment and services, reinforcing its strong presence in the power sector. This deal marks a significant boost for BHEL, which has already rallied 18.61% year-to-date in 2025.

At the time of writing, BHEL shares were up 1%.

On the technical front, SEBI-registered analyst Akhilesh Jat flagged a bullish price pattern on the daily chart, typically seen as a continuation setup. The stock is approaching a key resistance zone near ₹272 on a closing basis.

He recommended buying only if the stock closes above ₹272 for two consecutive sessions. If this occurs, he expects further upside potential towards ₹310 in the near term.

However, Jat warned that this bullish setup would be considered invalid if the price fell below ₹243, which is a key support and the lower boundary of the flag pattern.

Until the breakout is confirmed, he advised traders and investors to wait and watch rather than pre-empt the move. While the Adani Power deal strengthens BHEL’s fundamental outlook, its technical setup supports a cautiously optimistic view.

Jat reinforced that fresh buying should only be considered if the breakout is validated with sustained strength above ₹272, with a strict stop loss of ₹243.

He noted that, despite a healthy order book, the stock’s valuation remains stretched, with a price-to-earnings ratio of 172.21 — significantly above the sector average — and a modest return on equity of 1.15%, warranting cautious optimism.

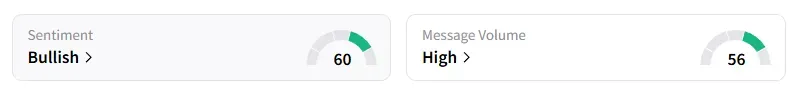

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter amid 'high' message volumes.

BHEL announced in April that its order inflows for fiscal year 2024-25 (FY25) reached an unprecedented ₹92,534 crore, marking the company's highest-ever order book. This recent order win further strengthens BHEL's project pipeline, which is now at its peak for FY25.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)