Advertisement|Remove ads.

Big Lots Files For Chapter 11 Bankruptcy, To Sell Assets To Nexus Capital Management: Retail Chatter Jumps

Discount retailer Big Lots (BIG) notified on Monday it has initiated voluntary Chapter 11 bankruptcy proceedings in the U.S. Bankruptcy Court for the District of Delaware. At the same time, the company has entered into an agreement with an affiliate of Nexus Capital Management under which Nexus will acquire its assets and ongoing business operations.

Following the disclosure, shares of the firm plunged over 39% in Monday’s pre-market session as of 6:57 a.m. ET.

Nexus will serve as the "stalking horse bidder" in a court-supervised auction process pursuant with the proposed transaction being subject to higher or better offers. Big Lots said if Nexus is deemed the winning bidder, the firms anticipate the transaction to close during the fourth quarter of 2024.

Big Lots, however, clarified that it will continue to serve customers at their store locations or online during and after the proceedings. However, as part of the court-supervised sale process, the firm is assessing its operational footprint, which will include closing additional store locations. Big Lots will also continue to evaluate and optimize its distribution center model.

Big Lots also clarified it has secured commitments worth $707.50 million of financing, including $35 million in new financing from some of its current lenders, in the form of a post-petition credit facility. This, coupled with cash generated from the firm’s ongoing operations, is expected to provide sufficient liquidity to support the company while the sale transaction is under process.

The company stated that like many other retail businesses, it has been adversely affected by recent macroeconomic factors such as high inflation and interest rates that are beyond its control. “The prevailing economic trends have been particularly challenging to Big Lots, as its core customers curbed their discretionary spending on the home and seasonal product categories that represent a significant portion of the company's revenue,” it said.

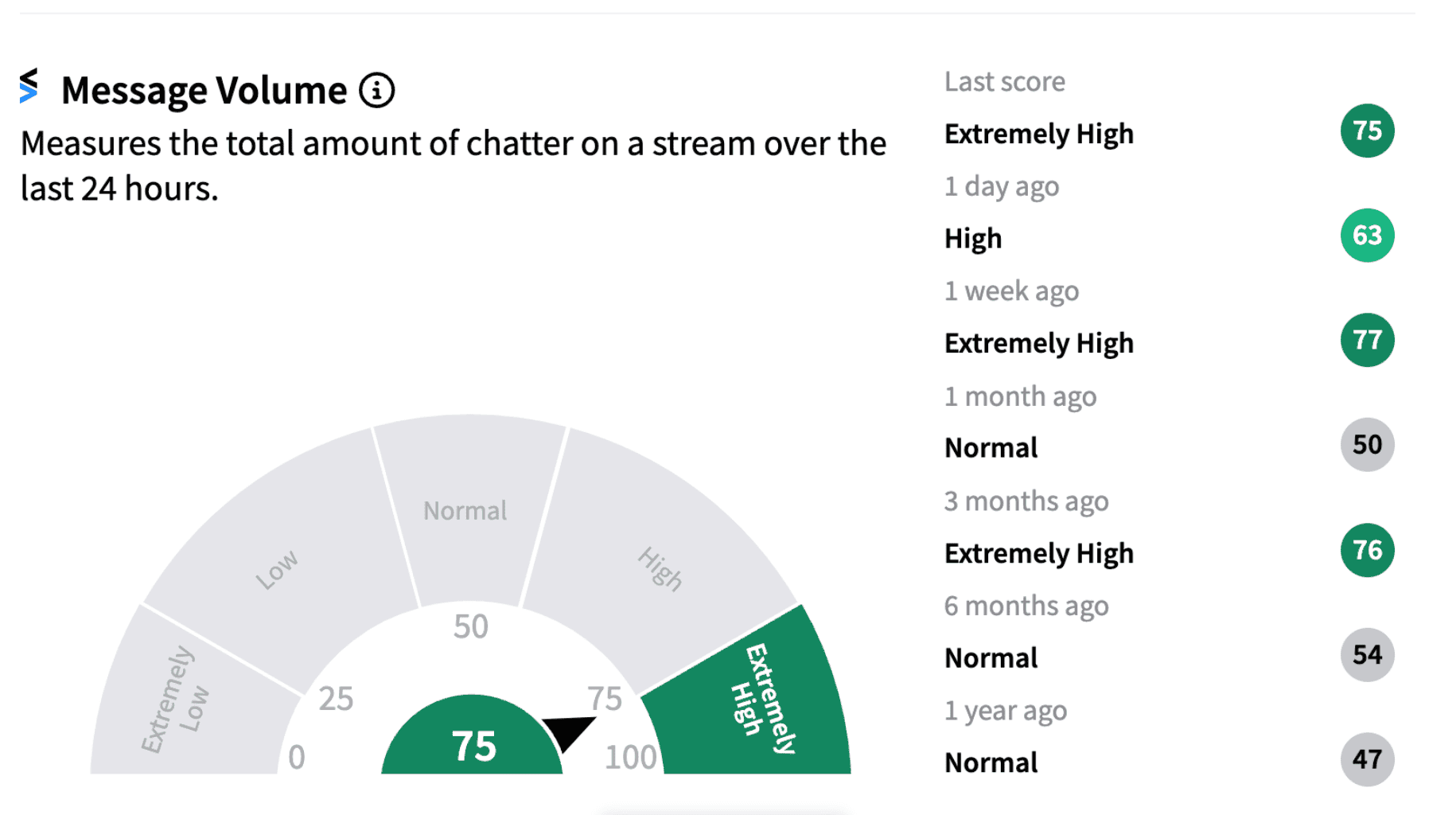

Following the announcement, message volumes on Stocktwits shot up into the ‘extremely high’ (75/100) area with message volumes jumping over 52% in the last 24 hours.

Big Lots Chapter 11 bankruptcy filing comes at a time when retail players have been struggling to keep up sales as demand remained weak in a sluggish economy. Even if the Federal Reserve starts its rate cut cycle in September, which it mostly likely would, it would be a few quarters before these players are likely to see a pick-up in demand. Until then, retailers will be busy implementing every trick in the rulebook to cut costs, optimize operations.

/filters:format(webp)https://news.stocktwits-cdn.com/large_klarna_OG_jpg_830d4c6bf5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Amgen_resized_jpg_c3e08049b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/02/Tata-Capital.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Starbucks_jpg_2601fff43f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_pharma_jpg_85fc834ec9.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/06/hdfc-bank-2025-06-de1e4f9e91ac2019dfe21de8f00b45da.jpg)