Advertisement|Remove ads.

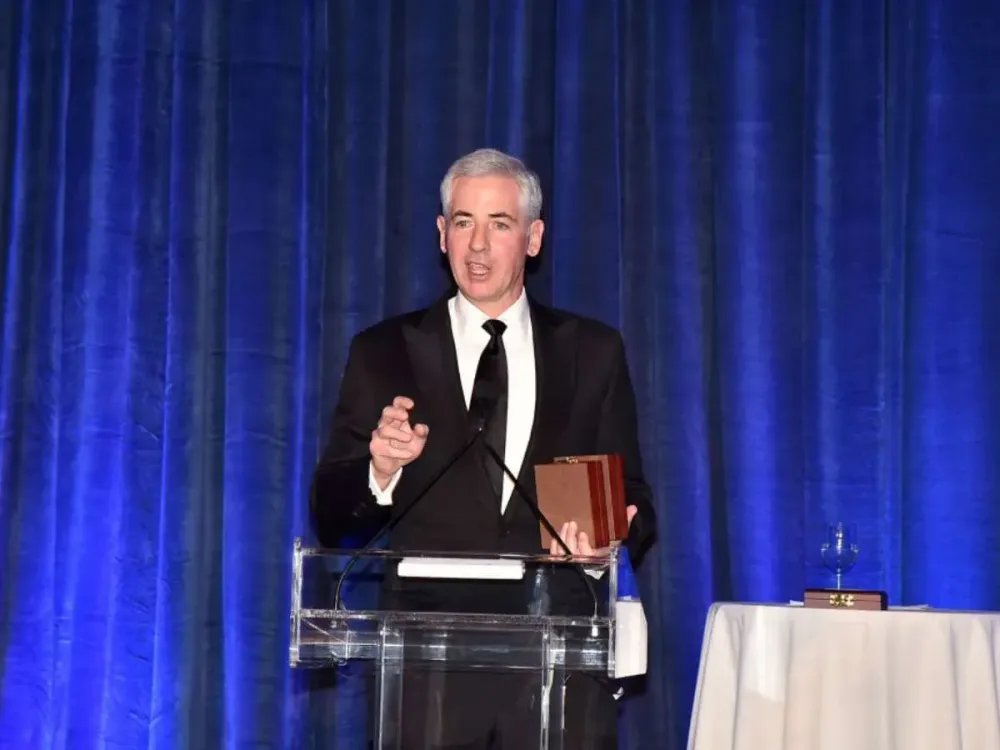

Bill Ackman Targets $5B IPO For New US Fund, With Some Free Shares As Sweetener: Report

- The firm’s partners are reportedly planning to offer up to 10% of their shares as part of the dual listing.

- The closed-end fund is expected to mimic Ackman's existing hedge fund but offer lower fees and faster access to capital.

- Ackman said last year he planned to list a similar fund, but temporarily pulled the listing after raising only about $2 billion.

Hedge fund manager Bill Ackman reportedly aims to raise $5 billion for his U.S.-listed closed-end fund, including $2 billion from well-known institutional investors who will anchor the deal.

According to a Bloomberg News report citing people familiar with the matter, the closed-end fund's initial public offering will coincide with the IPO of his hedge fund, Pershing Square Capital Management. The report further stated that Pershing would give fund investors some free shares in Pershing Square Capital as part of the deal.

Market Debut Could Come As Soon As Q1

The firm’s partners are reportedly planning to offer up to 10% of their shares as part of the dual listing, which could take place as early as the first quarter. According to a Reuters News report, the closed-end fund is expected to mimic Ackman's existing hedge fund but offer lower fees and faster access to capital. The move could increase the fund’s appeal among a broader pool of investors, including pension funds, endowments, and retail investors who are typically excluded from hedge funds.

Ackman said last year he planned to list a similar fund, Pershing Square USA Ltd., on the New York Stock Exchange and intended to raise as much as $25 billion, but temporarily pulled the listing after only raising about $2 billion.

The closed-end fund structure reportedly made it difficult to raise capital because such funds often trade at a discount to their underlying assets. The Bloomberg report stated that potential buyers held back from investing in the IPO, believing they could purchase the fund at a lower price after the listing. The proposal to include free shares could bolster appeal.

As per Reuters, Pershing Square oversees about $21 billion in assets, primarily held in its London-listed closed-end fund, Pershing Square Holdings. This fund has posted a 17.2% return since January and double-digit returns in both 2024 and 2023. Retail sentiment on Stocktwits about Pershing Square was in the ‘neutral’ territory at the time of writing.

Ackman sold a 10% stake in Pershing in a private deal that valued it at more than $10 billion ahead of the planned IPO last year. In May, Pershing boosted its stake in Howard Hughes Holdings to almost 47%, to build an insurer and expand the real estate company into a conglomerate with controlling stakes in other public and private businesses.

IPO Market Boom

According to Renaissance Capital data, 194 IPOs of companies with a market capitalization of $50 million or more have been priced this year, a 48.1% increase from last year. U.S. firms have raised $36.4 billion in proceeds.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)