Advertisement|Remove ads.

Abercrombie & Fitch Retail Traders Erupt In Cheer As Stock Scores Best Day Ever On Blowout Q3 — CEO Sees ‘Great Momentum’ Into Holidays

- Abercrombie & Fitch reported Q3 sales and profit that surpassed analysts' targets.

- Performance was driven by the company’s Hollister brand, which it expects will carry it through the holiday shopping period.

- ANF trended among the top 10 tickers on Stocktwits, with retail investors discussing whether the rally would hold and the possibility of a short squeeze.

Abercrombie & Fitch Co. jumped into Stocktwits’ top 10 trending tickers after surging 37.5% on Tuesday — its best day on record — following a strong fiscal third-quarter report.

The rally, which pushed shares to a two-month high, boosted sentiment among retail investors. However, some saw it as an oversized reaction to the earnings, saying the rally might lose steam the next day, while others discussed a potential short squeeze.

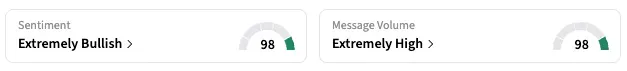

On Stocktwits, the sentiment for ANF shifted to ‘extremely bullish’ (98/100) as of late Tuesday, from ‘bullish’ the previous day, with ‘extremely high’ message volume.

‘Never Short A Low P/E Stock’

“ER was bad! People p*mping it will fall hard,” said one user, while another said they opened a short position. About 12.4% of the company’s shares were shorted, compared to 16% at the year’s peak in June, according to Koyfin.

Notably, Tuesday’s surge — coming just ahead of the key Black Friday–Cyber Monday shopping stretch — came after a prolonged slump, with the stock down roughly 56% for the year through Monday. “$ANF lesson of day, dont short 6.5 P/E stock,” said a user, referencing Abercrombie’s relatively low forward price-to-earnings ratio, a key valuation metric.

Q3 Performance

In Q3, Abercrombie’s net sales rose 7% to a record $1.29 billion, inching past FactSet’s analyst estimate of $1.28 billion. Adjusted earnings per share (EPS) fell to $2.36, but came in well above Wall Street’s target of $2.17.

The strong performance was driven by Hollister, which sells casual, beach-inspired apparel and accessories aimed at teens and young adults, thanks to back-to-school shopping. The brand’s sales rose 16%, while those of Abercrombie’s namesake brand declined 2%.

Holiday Season Comments

The company has campaigns and collaborations planned for Hollister for the holiday period, as it opens 25 new brand stores and refreshes 35 others this year, CEO Fran Horowitz said on the analyst call.

“We've got great momentum heading into [the] holiday season. Honestly, almost every category is working, which is super, super exciting,” Horowitz said.

For its holiday quarter, Abercrombie expects total sales to grow 4% to 6%, missing the analysts' 5.6% target, according to LSEG/Reuters. The company expected EPS between $3.40 and $3.70.

Abercrombie also raised the low end of its full-year sales outlook to up 6% from up 5%, while maintaining the high end at up 7%

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)