Advertisement|Remove ads.

Biohaven’s Phase II Depression Trial Falls Short, But Analysts Downplay Impact – Wall Street Looks Ahead To Epilepsy Data

- Analyst Myles Minter noted that the company’s pivotal Phase III study of BHV-7000 in focal-onset epilepsy in the first half of 2026 will be the critical factor.

- Citi emphasized that the study was expected to be difficult, and the company’s epilepsy program holds a higher probability of success.

- H.C. Wainwright was unsurprised by the depression study outcome but advised caution leading into the seizures data readout.

Biohaven Pharmaceuticals’ (BHVN) disappointing Phase II results for BHV-7000 in major depressive disorder have raised caution among Wall Street firms but have not completely shaken confidence in the company’s broader pipeline.

The company announced on Wednesday that its Phase 2 study of BHV-7000 did not meet its primary endpoint.

Analyst Reactions

William Blair expected challenges with the depression study, given difficulties in executing trials and the prevalence of placebo effects, according to TheFly.

Analyst Myles Minter maintained a ‘Market Perform’ rating on the stock, citing that the company’s pivotal Phase III study for BHV-7000 in focal onset epilepsy in the first half of 2026 will be the critical factor in determining the drug’s effectiveness in an extended-release formulation.

He added that the failure has minimal implications for Biohaven’s competitor, Xenon Pharmaceuticals' (XENE) depression trials.

Focus Shifts To 2026 Seizure Study

According to Samantha Semenkow of Citi, who maintained a ‘Buy’ rating with a $14 price target, the market is more focused on the upcoming Phase III epilepsy results for BHV-7000 in 2026 than on the Phase II depression data.

She emphasized that the earlier study was expected to be difficult, and the company’s epilepsy program holds a higher probability of success.

H.C. Wainwright was unsurprised by the depression study outcome but advised caution leading into the seizures data readout. The firm maintained that the Phase II miss does not significantly impact expectations for Xenon Pharmaceuticals’ azetukalner Phase III trial in major depressive disorder.

What’s The Retail Mood On Stocktwits?

Biohaven stock traded over 14% lower in Friday’s premarket, and it was the top-trending equity ticker on StockTwits.

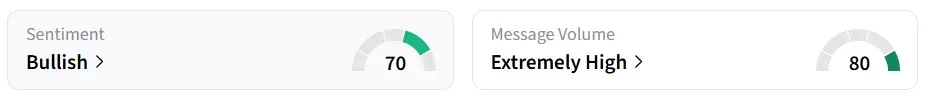

However, retail sentiment around the stock remained in ‘bullish’ territory amid ‘extremely high’ message volume levels.

BHVN stock has declined by over 71% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)