Advertisement|Remove ads.

BioLineRx Q1 Earnings Rise Despite Fall In Revenue: Retail Stays Super Confident

Nasdaq-listed shares of BioLineRx (BLRX) traded 4% higher on Tuesday afternoon after the company reported an over 600% year-on-year jump in its first-quarter net income.

The Israel-based biopharmaceutical company reported revenues for the three months ended March 31, 2025, of $0.3 million, compared to revenues of $6.9 million in the year-ago period, and below an analyst estimate of $1 million, as per Koyfin data.

BioLineRx out-licensed its FDA-approved Aphexda, used in treating a type of cancer called multiple myeloma, to Ayrmid last November and shut its U.S. commercial operations by the year-end.

Aphexda, however, generated sales of $1.4 million in the first quarter, providing the company with $0.3 million in royalties.

The fall in revenue in the first quarter reflects the company’s change in operation after out-licensing Aphexda, it said.

Net income for the quarter ended March 31, 2025, was $5.1 million, compared to $0.7 million for the quarter ended March 31, 2024, and above an estimated net loss of $3 million. The net non-operating income stood at $7.6 million, compared to net non-operating income of $4.5 million in the three months ended March 31, 2024.

The company ended the quarter with cash, cash equivalents, and short-term bank deposits of $26.4 million, which it expects to be sufficient through the second half of 2026.

CEO Philip Serlin said that the company has been actively evaluating new assets in the areas of oncology and rare diseases, where it can leverage its expertise after out-licensing Aphexda.

"I remain optimistic that we will announce a meaningful transaction this year," he said.

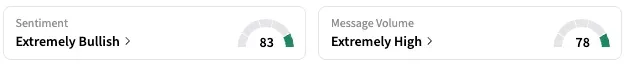

On Stocktwits, retail sentiment around BioLineRx rose within the ‘extremely bullish’ territory over the past 24 hours while message volume remained at ‘extremely high’ levels.

BLRX stock is down by about 63% this year and nearly 87% over the past 12 months.

Read Next: BYD Sued By Brazil Prosecutors For Alleged Human Trafficking: Retail’s In Wait-And-Watch Mode

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)