Advertisement|Remove ads.

BioNTech To Acquire CureVac In All-Stock Deal Valued At $1.25B: Retail Sees Breakthrough In Cancer Treatment

Germany-based biotechnology firm BioNTech SE (BNTX) on Thursday said that it intends to acquire its peer CureVac (CVAC) in an all-stock transaction. CVAC stock shot up by about 32% in pre-market trading.

Under the terms of the deal, each CureVac share will be exchanged for approximately $5.46 in BioNTech American depositary shares, resulting in an implied aggregate equity value for CureVac of roughly $1.25 billion.

BioNTech also stated that the purchase consideration is subject to a collar mechanism. If the 10-day volume-weighted average price of BioNTech ADS shortly before the closing of the offer exceeds $126.55, the exchange ratio would be 0.04318, and if the price is lower than $84.37, the exchange ratio would be 0.06476.

Upon closing of the transaction, CureVac shareholders are expected to own between 4% and 6% of BioNTech.

BioNTech will own 100% of CureVac and its subsidiaries, and it will integrate CureVac’s research and manufacturing site in Tübingen.

The companies stated that the acquisition will create long-term value for shareholders of both companies and will build on BioNTech’s track record in messenger ribonucleic acid (mRNA) commercialization, including its mRNA-based COVID-19 vaccine developed in collaboration with Pfizer Inc (PFE).

CureVac is developing a class of medicines in oncology and infectious diseases based on mRNA. BioNTech said that the transaction will strengthen the research, development, manufacturing, and commercialization of mRNA-based cancer immunotherapy candidates.

The transaction is expected to close in 2025, subject to the completion of customary closing conditions and receipt of regulatory approvals.

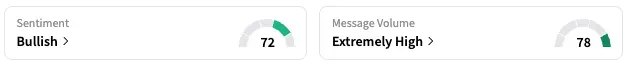

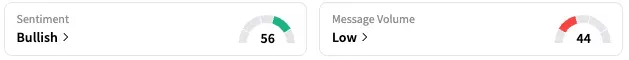

On Stocktwits, retail sentiment around CureVac jumped from ‘bearish’ to ‘bullish’ over the past 24 hours while message volume rose from ‘low’ to ‘extremely high’ levels.

A Stocktwits user, who claims to hold CureVac shares, expressed disappointment, opining that they could have gotten a better deal.

Meanwhile, retail sentiment around BioNTech rose from ‘neutral’ to ‘bullish’ over the past 24 hours while message volume fell from ‘normal’ to ‘low’ levels.

A Stocktwits user said the deal might lead to a “breakthrough” in cancer treatment.

BNTX is trading 1% higher in pre-market.

While BNTX shares are down by about 9% this year, CVAC shares are up by about 18%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_OG_jpg_9d414a2458.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)