Advertisement|Remove ads.

Bitcoin Miner IREN’s Stock Hits All-Time High — Retail Ponders If A Big Deal Is On The Cards

IREN Ltd (IREN) stock gained 5.8% in extended trading on Monday, after rising over 14% in the regular session to hit a fresh all-time high.

The stock gained over 77% in September, its best monthly performance since May 2024. Monday’s gains came amid a rise in broader markets propelled by a deal between OpenAI and AMD, which could hand the Sam Altman-led company a 10% stake in the chipmaker. Bitcoin prices also jumped to all-time highs.

However, the Bitcoin miner is undergoing a strategic shift to become an artificial intelligence data center operator. Last month, the company announced the doubling of its AI Cloud GPU capacity to 23,000, targeting $500 million in annualized revenue by early 2026. Iren is expected to provide a monthly update later this week.

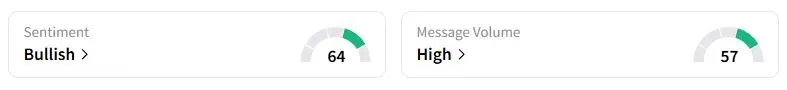

Retail sentiment on Stocktwits about IREN was in the ‘bullish’ territory at the time of writing, while retail message volume jumped over 385% over the past 24 hours.

“It’s institutional flow, hedge funds, or shorts covering. Whatever it is, it isn’t dumb retail money,” one Stocktwits user wrote, speculating whether a large deal might be around the corner.

“The only way this ramps this heavy … is if institutions have given up holding it back. Someone knows something. News is imminent,” another user wrote.

The company stated last month it had acquired an additional 12,400 GPUs for roughly $674 million. This includes 7,100 Nvidia B300s, 4,200 Nvidia B200s, and 1,100 AMD MI350Xs. Iren and its peers, such as Cipher Mining, are capitalizing on a surge in demand for AI data center capacity. Last month, a pure-play data center firm, Nebius, signed a $17.4 billion contract with Microsoft to provide GPU infrastructure.

IREN, which runs its data centers entirely through renewable energy, already has 810 megawatts of installed capacity in the U.S. across five locations. The company is also adding further capacity, with 2.1 GW under construction and over 1 GW in the pipeline.

IREN stock has risen more than fivefold this year. However, its lofty valuation has also attracted some scrutiny on Wall Street. Last month, JPMorgan Chase analysts downgraded the stock due to concerns over the recent surge in share prices.

Also See: Why Did Solaris Energy Infrastructure Stock Dip Over 6% After-Hours?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)