Advertisement|Remove ads.

Black Monday For Monday.Com Stock? Here’s What Co-CEO Roy Mann Said About Google Algorithm Impact

Monday.Com (MNDY) co-founder and co-CEO Roy Mann said that the company is feeling some impact from Google algorithm, resulting in a slowdown in the market.

“We are seeing some softness in the market due to Google algorithm,” Mann said during the second-quarter (Q2) earnings call.

Monday.Com stock plunged over 23% on Monday, after the morning bell. The company reported an operating loss of $11.5 million in the quarter against a profit of $1.8 million in the same quarter last year.

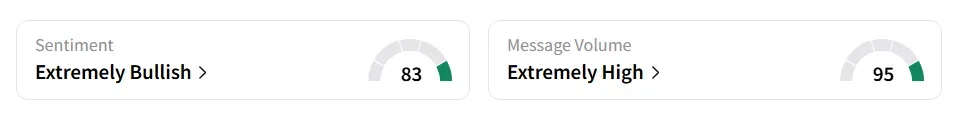

However, on Stocktwits, retail sentiment toward the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day amid ‘extremely high’ message volume levels.

Both retail sentiment and message volume were at a three-month high. The stock saw a 400% surge in user message count in 24 hours.

A Stocktwits user highlighted the pressure from Google.

Mann noted that customers’ adoption of the company’s AI capabilities increased in the quarter. “By embedding AI into the heart of our products, we are unlocking new capabilities for our customers,” Mann added.

Monday.Com’s second-quarter (Q2) revenue increased 27% year-on-year (YoY) to $299 million, beating the analysts’ consensus estimate of $293.5 million, as per Fiscal AI data. Adjusted EPS of $1.09 also exceeded the consensus estimate of $0.86. The operating cash flow for Q2 totaled $66.8 million, with an adjusted free cash flow of $64.1 million. For the third quarter (Q3), the company sees revenue between $311 million and $313 million.

Monday.Com stock has gained over 5% year-to-date and has shed over 4% in the last 12 months.

Also See: Why Is AMC Stock Rising Today? Retail Believes ‘Bears Are Under Crazy Pressure’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)