Advertisement|Remove ads.

BlackRock Bond Chief Sticks To Short-Term Maturities Despite Treasury Yield Spike After Moody's Downgrade

Despite a surge in 10- and 30-year Treasury yields following Moody’s recent U.S. credit downgrade, BlackRock’s Rick Rieder is sticking with shorter-dated bonds.

According to a CNBC report, the chief investment officer of global fixed income at the world’s top asset manager remains cautious about long-duration risk, favoring maturities in the three- to five-year range.

Rieder, who manages the iShares Flexible Income Active ETF (BINC), has been adjusting the portfolio amid shifting market dynamics.

After reducing high-yield exposure in April following tariff-driven market volatility, he is now adding selectively, focusing on higher-quality U.S. high-yield bonds, especially in the B-rated segment, which he calls the “sweet spot.”

“You get yield,” said Rieder. “Credit is in as good a shape as I've seen it in 30 years.”

BINC, launched in May 2023, has quickly grown to over $9 billion in assets, with about 40% in high-yield corporates and loans, mostly U.S.-based.

The ETF currently sports a 30-day SEC yield of 5.57% and a net expense ratio of 0.4%.

The 30-year Treasury briefly touched 5.03%, and the 10-year climbed above 4.5% on Monday after Moody’s cut the U.S. credit rating to Aa1 from Aaa. However, Rieder is wary of more volatility ahead on the long end of the curve.

He remains optimistic about the broader U.S. economy, but steers clear of CCC-rated bonds, which he says are vulnerable to a downturn.

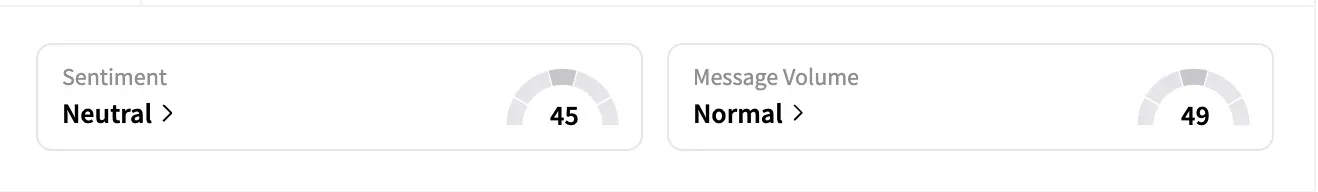

On Stocktwits, sentiment around BINC has cooled, sliding from ‘bullish’ to ‘neutral’ over the past six months. The most recent conversations centered on the fund's dividends and conservative returns.

“Paid $3.44 in 2024, which is about 6.5% after the management fee is subtracted, looks like the stock should appreciate 1-3% per year, this should easily give over 7% per year…outstanding for a fixed investment vehicle,” said one user.

Year-to-date, BINC has returned 0.3% on price alone and 2.14% with dividends. The SPDR S&P 500 ETF (SPY) has returned 1.8% and the Invesco QQQ Trust (QQQ) 2.26%, accounting for quarterly cash dividends.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)