Advertisement|Remove ads.

Opendoor Stock Still Under Pressure: Retail Traders Admit Being Rattled A Bit By New 3-Tier ‘KAZ’ Warrants

- Opendoor’s Nov. 18 (5 pm ET) record date for its special “KAZ” warrants has now passed.

- Retail investors flagged selling pressure amid the issue, with the stock sliding on Tuesday.

- Stocktwits sentiment for OPEN has shifted lower to ‘bullish’ over the past week.

Opendoor Technologies, Inc. shares remained under pressure on Tuesday as a warrants issue continued to split investor sentiment.

OPEN stock dropped 4% on Tuesday, its fourth straight session of decline, and then another 4.5% in the after-market session. The company had set Nov. 18, 5 pm ET as the record date for issuing its special KAZ warrants.

Holders of lots of 30 Opendoor shares will get one warrant per lot. The warrants are split into three series — K, A, and Z — each with a different exercise price: $9 (Series K), $13 (Series A), and $17 (Series Z). Following the Nov. 21 distribution date, the warrants will trade on the Nasdaq and can be exercised before Nov. 20, 2026.

As of the time this article was written, Opendoor had not posted an update on the issue.

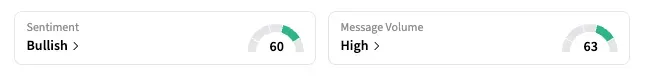

On Stocktwits, the retail sentiment for OPEN has inched lower over the past seven days, shifting to ‘bullish’ as of early Wednesday from ‘extremely bullish’ on the same day last week.

“$OPEN Trend still down on $OPEN, every rally gets slapped instantly — bears firmly in control,” said one user, with another saying that the trading activity showed “risk of a deeper drop.”

A segment of users also admitted being unsure of how to read into the warrants issue and the ongoing options and short trades.

In recent days, users on X and Stocktwits also noticed that Opendoor’s stock was unavailable for trading overnight on one platform, fueling speculation. “I think it has to do with an announcement coming in the morning about a partnership with HOOD,” the Stocktwits member said. No such announcement has happened so far.

Meanwhile, a regulatory filing showed that interim CFO Christina Schwartz sold about 74,000 shares on Monday, at roughly $7.90 each for total proceeds of about $584,000. The sale was automatically executed to cover taxes on her restricted stock units. After the transaction, she still holds roughly 528,000 shares of the company.

OPEN stock is down about 30% from its peak on Sept. 11 but reamins 363% up year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)